Historical Background of Zimbabwean Currency

The history of Zimbabwean currency reflects a turbulent economic past marked by hyperinflation and monetary instability. Over the years, Zimbabwe has experienced significant shifts in its monetary system, transitioning from traditional currencies to the introduction of local banknotes issued by the Reserve Bank of Zimbabwe. Notably, during the late 2000s, hyperinflation reached unprecedented levels, leading to the issuance of a series of increasingly worthless banknotes, including the infamous 100 trillion Zimbabwean dollar bill. This period symbolizes one of the most extreme cases of currency devaluation in modern history.

Pre-colonial Currency Systems

The historical background of Zimbabwean currency reflects a complex evolution shaped by pre-colonial economic activities and subsequent colonial influences. Before the arrival of European settlers, indigenous communities utilized various barter systems and traded goods such as cattle, grains, and salt to facilitate economic exchanges. These societies often engaged in community-based trade, relying on customary practices rather than formal currency. As trade networks expanded, some groups began to develop rudimentary forms of currency, including shell beads and metal objects, which served as symbols of wealth and exchange. The introduction of metal currency and trading systems laid the groundwork for more sophisticated monetary practices. When colonial powers arrived, they imposed their monetary policies and introduced official currency systems, heavily influencing Zimbabwe’s economic history. This rich pre-colonial foundation set the stage for the complex monetary history that would follow, culminating in modern phenomena such as the hyperinflation era with the infamous 100 trillion Zimbabwean dollar notes.

Colonial Era and Introduction of the Pound

The history of Zimbabwean currency is closely linked to its colonial past and economic challenges, culminating in the introduction of the Zimbabwean dollar and the infamous 100 trillion dollar banknotes. During the colonial era, the economic system was structured around British monetary standards, with the South African pound being used as the official currency before the country gained independence. The use of the pound was a reflection of colonial influence and the integration of Zimbabwe’s economy with that of Britain and neighboring countries.

When Zimbabwe gained independence in 1980, the country initially continued using the British pound until it adopted its own currency. In 1980, the Zimbabwean dollar was introduced, replacing the pound at par. Over the years, the currency experienced significant inflation, especially during the late 1990s and early 2000s, which severely devalued the dollar. The hyperinflation crisis peaked around 2008, leading to the issuance of increasingly larger denominations, including the 100 trillion Zimbabwean dollar banknotes, which became a symbol of economic collapse.

- Colonial Era and British Influence: Zimbabwe’s monetary system was initially based on British standards, with the pound Sterling as the official currency.

- Introduction of the Zimbabwean Dollar: After independence, Zimbabwe launched its own currency in 1980, replacing the pound at parity.

- Hyperinflation and Currency Collapse: From the late 1990s to 2008, runaway inflation led to the issuance of increasingly larger notes, culminating in the 100 trillion dollar note.

Post-independence Monetary Policies

The historical background of Zimbabwean currency is marked by significant economic challenges, particularly the hyperinflation experienced in the late 1990s and 2000s. Zimbabwe’s monetary system has undergone various transformations, beginning with the use of the Rhodesian dollar prior to independence in 1965, followed by the Rhodesian rand and then the Zimbabwean dollar after independence in 1980. During this period, the country faced rising inflation, but it was not until the early 2000s that hyperinflation reached catastrophic levels, peaking at an estimated 79.6 billion percent month-on-month in November 2008.

Post-independence monetary policies were initially aimed at stabilizing the economy and fostering growth. The Reserve Bank of Zimbabwe adopted measures such as interest rate adjustments and currency reform to control inflation. However, these efforts were overwhelmed by economic mismanagement, land reform policies, and a decline in agricultural productivity. As inflation spiraled out of control, the government resorted to printing increasingly larger denominations to cope with the collapsing economy, resulting in the issuance of a 100 trillion Zimbabwean dollar note in 2008, which became a symbolic representation of the economic crisis.

Following the hyperinflation crisis, Zimbabwe abandoned its own currency in 2009 and adopted multi-currency systems, including the US dollar and South African rand, to stabilize the economy. Later, in 2019, the Reserve Bank of Zimbabwe introduced a new Zimbabwean dollar, aiming to restore monetary sovereignty. Despite these reforms, challenges remain, and the history of Zimbabwean currency is a testament to the profound impact of poor monetary policies and economic instability on a nation’s financial system.

Rise of Hyperinflation and Currency Collapse

The rise of hyperinflation and currency collapse has devastated economies around the world, with Zimbabwe’s 100 trillion dollar banknotes becoming a symbol of economic collapse. During a period of rapid inflation, the value of the national currency plummeted, rendering everyday transactions almost impossible and leading to severe financial instability. This dramatic scenario highlights the destructive power of unchecked inflation and the challenges countries face in maintaining economic stability amidst crisis conditions.

Factors Leading to Hyperinflation

The rise of hyperinflation and currency collapse can be attributed to a combination of economic, political, and social factors that destabilize a nation’s monetary system. In the case of Zimbabwe, hyperinflation reached extraordinary levels, with the currency peaking at 100 trillion dollars, reflecting the severity of the economic crisis. Key factors leading to hyperinflation include excessive money printing by the central bank, often in response to large fiscal deficits and economic shocks, which devalues the currency rapidly. Loss of confidence among citizens and investors further exacerbates the situation, as people seek alternative stores of value, accelerating demand for foreign currencies or commodities. Political instability, poor economic management, and land reforms can also undermine productive sectors, reducing output and fueling inflationary pressures. Additionally, external pressures such as sanctions or declining commodity prices can weaken a nation’s economy, prompting extraordinary monetary expansion to cover deficits. All these elements create a cycle of rising prices that spirals out of control, ultimately leading to the collapse of the national currency, as witnessed in Zimbabwe’s dramatic inflationary episode.

The 2008 Currency Crisis

The 100 trillion Zimbabwe dollar symbolizes the extreme hyperinflation and currency collapse experienced in Zimbabwe during the late 2000s. As inflation spiraled out of control, the government continued to print more money, rendering the currency virtually worthless and leading to a complete collapse of the financial system. This crisis was marked by astronomical inflation rates, with prices doubling daily and the need for ever-increasing denominations, culminating in the issuance of banknotes worth 100 trillion Zimbabwe dollars. Such hyperinflation eroded savings, devastated economic stability, and caused widespread hardship for the population.

Impact on Economy and Society

The rise of hyperinflation and currency collapse, exemplified by the case of Zimbabwe’s 100 trillion dollar note, profoundly impacts both the economy and society. Hyperinflation occurs when a country’s inflation rate accelerates uncontrollably, eroding the value of its currency and making everyday transactions difficult. Zimbabwe experienced such hyperinflation in the late 2000s, where the government issued increasingly larger denominations, culminating in the iconic 100 trillion dollar note. This leads to a loss of public confidence in the monetary system, as people rush to spend their money before it loses more value, creating a vicious cycle of inflation. The economy suffers as savings become worthless, investments dry up, and business operations are disrupted, resulting in widespread unemployment and economic stagnation. Society bears significant hardships too, as people struggle to afford basic necessities like food, medicine, and housing. The social fabric is strained as poverty, uncertainty, and unrest grow, ultimately forcing many to seek alternative currencies or emigrate. Overall, hyperinflation and currency collapse devastate economic stability and societal cohesion, leaving long-lasting scars on the nation’s development and the well-being of its citizens.

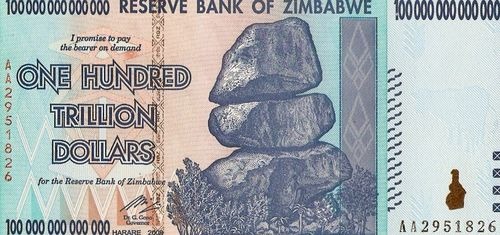

The 100 Trillion Zimbabwean Dollar Note

The 100 trillion Zimbabwean dollar note stands as a symbol of one of the most hyperinflationary periods in history. Issued during a time of severe economic crisis, this large denomination reflects the extreme devaluation of the Zimbabwean dollar and the extraordinary measures taken by the government to cope with runaway inflation. It remains a notable artifact indicative of economic instability and the challenges faced by Zimbabwe during the late 2000s.

Introduction and Significance

The 100 trillion Zimbabwean dollar note is one of the most iconic and symbolic currencies in recent economic history. Issued during a period of hyperinflation in Zimbabwe, it represented the extraordinary levels of inflation that the country experienced in the late 2000s. The note’s staggering denomination, equivalent to one hundred trillion Zimbabwean dollars, highlights the profound devaluation of the currency and the severity of the economic crisis.

This banknote is significant because it vividly illustrates the impact of hyperinflation on everyday life and the challenges faced by the economy. It became a tangible symbol of Zimbabwe’s financial turmoil, reflecting the rapid loss of currency value and the struggles of ordinary citizens to cope with skyrocketing prices. The 100 trillion dollar note serves as a historical reminder of the importance of monetary stability and responsible economic management.

Features of the 100 Trillion Note

The 100 trillion Zimbabwean dollar note is a notable example of hyperinflation and economic instability in Zimbabwe’s history. This banknote features a vibrant, colorful design that highlights the country’s cultural heritage and national symbols. On the front, it prominently displays the Zimbabwe National Parliament building along with intricate patterns and security features such as watermarks and metallic threads to prevent counterfeiting. The note also includes images representing Zimbabwe’s natural resources and agricultural significance. The reverse side showcases the country’s coat of arms and central bank details. Overall, the note’s size, vivid imagery, and security features reflect the extraordinary measures taken during a period of economic crisis, making it a significant collector’s item and symbol of Zimbabwe’s hyperinflation era.

Public Reaction and Collectors’ Interest

The 100 trillion Zimbabwean dollar note has captured significant public attention and collector interest due to its extraordinary face value and the economic context in which it was issued. During a period of hyperinflation in Zimbabwe, the government introduced increasingly higher denominations, culminating in the issuance of this note, which symbolized the severe economic instability of the time. Many people view it as a remarkable relic of a tumultuous period in the country’s history, evoking both frustration and historical curiosity.

For the general public, the note often serves as a symbol of the economic challenges Zimbabwe faced, with some viewing it as a reminder of the importance of stable currency management. Collectors, however, see it as a rare and iconic piece of currency history. Its large denomination and unique story make it highly sought after in numismatic circles. The note’s vivid design, historical significance, and the story of hyperinflation have spurred considerable interest among currency enthusiasts worldwide, elevating it to a coveted collector’s item.

Economic Implications of Such a High Denomination

The introduction of a 100 trillion Zimbabwean dollar note signifies a dramatic response to hyperinflation and economic instability. Such a high denomination reflects the severity of currency devaluation and impacts various aspects of the economy, including inflation rates, consumer confidence, and monetary policy. This article explores the economic implications of issuing these extreme banknotes, highlighting the challenges and adjustments faced by the Zimbabwean economy in its attempt to stabilize and regain trust.

Inflation and Price Levels

The introduction of a 100 trillion Zimbabwean dollar denomination reflects severe economic instability characterized by hyperinflation, which drastically erodes the value of the currency. Such high denominations are often a response to escalating inflation and skyrocketing price levels, making everyday transactions cumbersome and inefficient. As inflation accelerates, the real purchasing power of money diminishes rapidly, leading to a loss of confidence among consumers and investors.

Hyperinflation erodes savings and discourages long-term investments, as prices fluctuate unpredictably and store of value becomes unreliable. Businesses face the challenge of constantly adjusting prices, which increases costs and complicates planning and budgeting processes. The excessive supply of money in the economy, without a corresponding increase in goods and services, results in inflationary spirals that make traditional measures of economic stability ineffective.

The use of such high denominations also impacts monetary policy and economic credibility. It often signals deeper underlying issues, such as fiscal deficits, government debt, and loss of confidence in the monetary system. In extreme cases, hyperinflation can lead to dollarization or abandonment of the local currency altogether, further destabilizing the economy. Ultimately, these phenomena highlight the importance of sound fiscal policies and monetary discipline to maintain stable price levels and preserve economic stability.

Money Supply and Currency Devaluation

The introduction of the 100 trillion Zimbabwean dollar highlights significant economic challenges faced by the country, particularly concerning money supply and currency devaluation. Such a high denomination indicates hyperinflation, where the rapid increase in prices diminishes the currency’s purchasing power. When a government continually prints money to cover deficits or stimulate the economy, it often leads to excessive money supply, which exacerbates inflationary pressures. As inflation spirals out of control, currency devaluation occurs, making the local currency less valuable compared to foreign currencies. This situation discourages savings and investment, disrupts international trade, and erodes public confidence in the financial system. Ultimately, the use of hyperinflated denominations like 100 trillion Zimbabwean dollars reflects deeper structural issues such as fiscal mismanagement, loss of productive economic activities, and political instability, making economic recovery increasingly difficult without substantial reforms.”

Challenges in Monetary Policy Management

The introduction of a 100 trillion Zimbabwe dollar note has significant economic implications, primarily reflecting hyperinflation and a loss of confidence in the country’s monetary system. Such high denominations often indicate that the value of the currency is rapidly diminishing, which can lead to increased transaction costs and difficulties in daily commerce. This scenario complicates monetary policy management as central banks struggle to control inflation without destabilizing the economy further.

Managing monetary policy in this context becomes particularly challenging because traditional tools, like adjusting interest rates, lose effectiveness when inflation is uncontrollably high. The issuance of colossal denominations can also signal a disregard for fiscal discipline, potentially fostering inflationary expectations among the populace. This environment makes it difficult for policymakers to implement measures that restore stability, as any attempt to tighten monetary policy may be overshadowed by the persistent inflationary pressures.

Furthermore, such high denominations diminish the confidence of both domestic and international investors, leading to capital flight and reduced foreign investment. The costs associated with printing and managing such large bills are also substantial, diverting resources from productive economic activities. Overall, a 100 trillion dollar note exemplifies the extreme monetary instability faced, highlighting the need for comprehensive reforms and credible monetary policies to regain economic stability.

Transition to Multi-Currency System

The transition to a multi-currency system represents a significant shift in a nation’s financial and economic landscape, allowing for greater stability and flexibility. In the context of Zimbabwe, where hyperinflation previously crippled the local currency, adopting multiple currencies has been a strategic move to restore confidence and facilitate smoother transactions. This shift is particularly noteworthy given Zimbabwe’s recent economic history, including the notable value of the 100 trillion Zimbabwean dollar notes, symbolizing the challenges faced and the steps taken toward monetary reform.

Adoption of Foreign Currencies

The transition to a multi-currency system in Zimbabwe marked a significant shift in the country’s economic landscape, especially amid hyperinflation that rendered the local currency, the Zimbabwean dollar, practically worthless. As inflation spiraled out of control, the government and citizens turned to foreign currencies to stabilize transactions and restore economic confidence.

Adopting foreign currencies helped to control hyperinflation and facilitate smoother trade and commerce. This process involved several key steps:

- Officially allowing the use of foreign currencies such as the US dollar and South African rand for retail and business transactions.

- Phasing out the local currency for everyday use, gradually replacing it in the financial system.

- Encouraging both domestic and international confidence in the monetary system by stabilizing prices and reducing inflation rates.

- Implementing policies to monitor and regulate currency exchange to prevent black market activities and ensure exchange rate stability.

The shift to a multi-currency system was instrumental in stabilizing Zimbabwe’s economy during a turbulent period. This move not only helped curb hyperinflation but also opened up the nation’s economy to increased foreign investment and trade, paving the way for economic recovery and growth.

Stabilization Measures

The transition to a multi-currency system in Zimbabwe was a response to the severe economic instability experienced after the hyperinflation period that reached 100 trillion Zimbabwean dollars. This shift aimed to stabilize the economy, restore confidence, and facilitate smoother transactions by allowing alternative foreign currencies to coexist with the local currency.

Stabilization measures implemented during this transition included several key strategies:

- Allowing the use of foreign currencies such as the US dollar, South African rand, and Botswana pula for daily transactions.

- Implementing a new, more stable local currency to replace the hyperinflated Zimbabwe dollar.

- Introducing monetary policy measures to control inflation and stabilize prices.

- Reforming banking and financial systems to improve liquidity and credit access.

- Establishing strict fiscal discipline to reduce budget deficits and restore economic confidence.

- Encouraging foreign investment and remittances to boost foreign currency reserves.

Current Monetary Framework

The transition to a multi-currency system in Zimbabwe represents a significant shift from its previous monocurrency approach, aiming to stabilize the economy and restore public confidence. Zimbabwe’s current monetary framework has evolved through various phases, especially after experiencing hyperinflation that rendered the local currency nearly worthless. Implementing a multi-currency system allows the country to stabilize prices and promote international trade by utilizing more stable foreign currencies.

This shift has facilitated broader economic activities and encouraged investment, but it also presents challenges in managing monetary policy without a national currency. The use of foreign currencies such as the US dollar and South African rand has become common, providing a foundation for economic recovery. The key elements of Zimbabwe’s current monetary framework include:

- Adoption of multiple foreign currencies for transactions.

- Discontinuation of the Zimbabwean dollar in favor of foreign currencies.

- Implementation of inflation control measures to stabilize the economy.

- Efforts to eventually reintroduce a local currency with prudent monetary policies.

- Maintenance of financial stability and inflation targeting to regain trust in the financial system.

The ongoing transition aims to support economic growth, reduce hyperinflation impacts, and establish a sustainable monetary environment. As Zimbabwe moves beyond the 100 trillion dollar hyperinflation era, these changes are crucial for rebuilding the country’s economic integrity and international standing.

Lessons Learned and Future Outlook

Lessons learned from the journey toward achieving 100 trillion Zimbabwe highlight the complexities and challenges faced during this remarkable economic milestone. Reflecting on past experiences offers valuable insights into the factors that influenced inflation, monetary policy, and economic resilience. Looking ahead, the future outlook emphasizes the importance of sustainable growth, sound governance, and innovative strategies to maintain stability and foster development in Zimbabwe.

Economic Reforms and Recovery Plans

The introduction of the 100 trillion Zimbabwe dollar marked a pivotal moment in the country’s economic history, highlighting the severe inflation and hyperinflation crisis that led to the abandonment of traditional currency systems. Lessons learned from this period emphasize the importance of prudent monetary policies, transparent governance, and the need for economic diversification to prevent such crises in the future. Moving forward, Zimbabwe aims to stabilize its economy through comprehensive reforms that restore investor confidence, control inflation, and foster sustainable growth.

Future outlooks include a focus on implementing structural reforms, strengthening fiscal discipline, and encouraging foreign investment. The government recognizes that rebuilding economic resilience requires a combination of modernization efforts, improved governance, and fostering a stable macroeconomic environment. Recovery plans are centered around supporting key sectors such as agriculture, mining, and manufacturing to diversify income sources and ensure long-term stability.

Economic reforms are targeting currency stabilization, the development of financial institutions, and the creation of an enabling environment for entrepreneurship and innovation. These measures aim to restore trust in the economy and rebuild the livelihoods of Zimbabweans, paving the way for sustainable development and a prosperous future despite the scars of hyperinflation past.

Preventative Measures Against Hyperinflation

The experience of Zimbabwe’s hyperinflation, reaching a staggering 100 trillion percent, offers valuable lessons on the importance of sound economic policies and fiscal discipline. It underscores the dangers of excessive money printing without corresponding growth in productivity and the need for credible financial management. Ensuring transparency, establishing independent monetary authorities, and maintaining a balanced budget are essential measures to prevent similar crises.

Looking ahead, fostering economic stability involves diversifying the economy, strengthening institutions, and building foreign reserves to bolster confidence. Digital financial systems and prudent regulation can help mitigate risks associated with rapid currency devaluation. Countries must prioritize long-term economic planning and avoid short-sighted policies that can undermine monetary stability, learning from Zimbabwe’s experience to build resilient economies.

Prospects for a Stable Zimbabwean Economy

The Zimbabwean economy, marked by the unprecedented 100 trillion dollar currency note, offers valuable lessons on the impact of hyperinflation and economic instability. Key lessons include the importance of sound monetary policies, fiscal discipline, and the need for institutional reforms to restore confidence in the financial system. Additionally, it underscores the dangers of excessive money printing and reliance on unconventional economic measures without supporting structural reforms.

Looking ahead, the outlook for a stable Zimbabwean economy hinges on implementing comprehensive economic reforms aimed at stabilizing inflation, attracting foreign investment, and diversifying economic activities. Strengthening governance, improving policy transparency, and fostering regional trade partnerships are essential steps towards recovery. With sustained efforts, Zimbabwe can transition from economic crisis to stability, paving the way for sustainable growth and improved living standards for its citizens.

0 Comments