Overview of Zimbabwe’s Currency and Economic Context

Zimbabwe’s currency history has been marked by periods of hyperinflation and economic instability, significantly impacting the value of its money. The country experienced extreme inflation rates, culminating in the near-worthlessness of the Zimbabwean dollar, leading to the introduction of new currency measures and multiple revaluations. In recent years, Zimbabwe has transitioned towards using foreign currencies such as the US dollar to stabilize its economy. This context is essential when exploring the exchange rate and the surprising value of large amounts like 1 trillion Zimbabwean dollars in US dollars.

History of Zimbabwe’s Currency Fluctuations

Zimbabwe’s currency history is marked by significant fluctuations and periods of hyperinflation, reflecting the country’s economic challenges over the decades. The Zimbabwean dollar, once a symbol of national sovereignty, experienced exponential inflation rates, especially during the late 2000s, which diminished its value rapidly.

Historically, Zimbabwe faced economic instability due to factors such as political turmoil, land reform policies, and fiscal mismanagement. These issues led to soaring inflation, peaking in 2008 when hyperinflation reached an estimated 79.6 billion percent month-on-month. As a result, the Zimbabwean dollar became virtually worthless, and the government resorted to issuing massive banknotes in denominations such as the one trillion dollar note.

The issuance of the 1 trillion Zimbabwean dollar note was a response to hyperinflation, intended to facilitate daily transactions amid the currency’s severely diminished real value. However, it became a symbol of the economic chaos and loss of confidence in the local currency. In 2009, Zimbabwe abandoned its own currency, adopting foreign currencies like the US dollar and South African rand to stabilize the economy.

Today, Zimbabwe primarily trades using these foreign currencies, with the Zimbabwean dollar reintroduced in 2019 as a local currency but with limited international exchange. The conversion of large Zimbabwean banknotes, especially high-denomination bills like the 1 trillion note, into USD highlights the extent of the currency’s devaluation and underscores the country’s ongoing struggle with inflation and economic stability.

Impact of Hyperinflation on Currency Value

Zimbabwe’s currency has experienced significant fluctuations over the years, largely influenced by economic instability and hyperinflation. The country previously used the Zimbabwe dollar, which saw rapid depreciation due to hyperinflation, leading to the issuance of multiple new currency notes and the eventual abandonment of the local currency in favor of foreign currencies like the US dollar and South African rand. The impact of hyperinflation on currency value has been substantial, eroding savings and making everyday transactions difficult, as prices spiraled out of control.

One of the most notable episodes of hyperinflation in Zimbabwe occurred in the late 2000s, with inflation rates reaching as high as 79.6 billion percent per month in November 2008. During this period, the official currency lost almost all its value, prompting the government to print increasingly larger denomination notes, including the infamous 100 trillion Zimbabwe dollar note. The hyperinflation crisis led to the exchange rate of 1 trillion Zimbabwean dollars being worth only a few US cents or less, highlighting the devastating effect on currency stability and value.

Today, Zimbabwe largely relies on foreign currencies for transactions, but historical hyperinflation episodes continue to influence perceptions of the country’s monetary system. The comparison of 1 trillion Zimbabwean dollars to USD exemplifies the extent of inflation and the punctuated collapse of the local currency’s value during the crisis. This episode remains a stark reminder of how hyperinflation can undermine economic stability and trust in a nation’s monetary policy.

Transition from Zimbabwean Dollars to Multi-Currency System

Zimbabwe’s currency history has been marked by significant economic challenges, including hyperinflation that peaked in the late 2000s, leading to the issuance of the Zimbabwean dollar in various forms. During this period, the value of the local currency plummeted, rendering it virtually worthless and causing widespread economic instability. In response to these issues, the government eventually adopted a multi-currency system in 2009, allowing the use of foreign currencies such as the US dollar, South African rand, and others for transactions. This transition aimed to stabilize the economy, curb hyperinflation, and restore confidence in the financial system. Under this multi-currency arrangement, the Zimbabwean dollar was effectively sidelined, and the nation’s economy became more aligned with global financial systems. Discussing the value of 1 trillion Zimbabwean dollars in USD highlights the extreme devaluation experienced during hyperinflation, illustrating the importance of the shift to a multi-currency system for economic recovery and stability.

Conversion of 1 Trillion Zimbabwean Dollars to USD

The conversion of 1 trillion Zimbabwean Dollars to USD highlights the impact of Zimbabwe’s hyperinflation and currency devaluation. Understanding this exchange provides insight into the country’s economic situation and the value of its currency relative to the US dollar. This article explores the current rates and implications of converting such a substantial amount of Zimbabwean currency into US dollars.

Historical Exchange Rate Data

The conversion of 1 trillion Zimbabwean Dollars to USD varies significantly depending on the historical exchange rate at the time of conversion, reflecting the hyperinflation period that Zimbabwe experienced. During this period, the Zimbabwean dollar rapidly depreciated, and official exchange rates often did not match the black market rates, making accurate conversions challenging.

- The Zimbabwean dollar experienced hyperinflation from the late 2000s, with rates reaching extraordinary levels by 2008.

- In 2008, the Reserve Bank of Zimbabwe introduced a series of redenominations, eventually leading to the abandonment of the Zimbabwean dollar in favor of foreign currencies.

- Historical exchange rates showed that, at the peak of hyperinflation, 1 USD could buy trillions of Zimbabwean dollars on the black market.

- For example, in 2008, the parallel market rates suggested that 1 USD might have exchanged for approximately 2.4 trillion Zimbabwean dollars at the height of hyperinflation.

- Due to hyperinflation and currency reforms, actual conversion rates fluctuate widely and are often only meaningful in historical context, rather than current practical use.

- Today, the Zimbabwean dollar has been phased out, and the country primarily uses foreign currencies like USD and South African Rand, making direct conversions historical or theoretical rather than current.

Factors Influencing Currency Conversion Rates

The conversion of 1 trillion Zimbabwean Dollars to USD involves understanding the current exchange rate and the economic factors influencing it. Zimbabwe has experienced significant inflation in recent years, which has drastically affected the value of its currency, often leading to hyperinflation and currency devaluation. As a result, the official or market exchange rates may vary widely, and the nominal value of 1 trillion Zimbabwean Dollars may translate into a relatively small amount in USD.

Several factors influence the currency conversion rates between Zimbabwean Dollars and USD. These include inflation rates, monetary policy decisions by Zimbabwe’s Reserve Bank, political stability, economic performance, and international trade dynamics. External factors such as global commodity prices and foreign investment also play roles. Since Zimbabwe’s economy has faced volatility, exchange rates can change rapidly and unpredictably, making precise conversions challenging without real-time data.

Calculation Methodology for Conversion

Converting 1 trillion Zimbabwean Dollars (ZWD) to US Dollars (USD) involves a straightforward calculation based on the current exchange rate between the two currencies. Since Zimbabwean Dollars have experienced significant devaluation, it is essential to use the latest available exchange rate for accurate conversion.

- Obtain the current exchange rate from a reliable financial source or currency exchange platform, which states how many Zimbabwean Dollars are equivalent to one US Dollar.

- Identify the amount in Zimbabwean Dollars to convert, which in this case is 1 trillion ZWD.

- Apply the conversion formula: USD = ZWD / Exchange Rate.

- Perform the division: divide 1,000,000,000,000 (1 trillion) by the latest exchange rate to find the equivalent amount in USD.

Note that the exchange rate for Zimbabwean Dollars can fluctuate significantly due to economic conditions, so always use the most recent rate for precise calculations.

Current Exchange Rate and Market Conditions

The current exchange rate and prevailing market conditions play a crucial role in determining the value of currencies and influencing international financial transactions. As global markets fluctuate due to economic policies, geopolitical events, and market sentiment, understanding these dynamics is essential for investors and traders alike. When examining the conversion of Zimbabwean dollars to USD, especially in the context of significant sums like one trillion dollars, market conditions can greatly impact the actual value and the ease of conducting such large-scale currency exchanges.

Latest USD to Zimbabwe Dollar Exchange Rates

The current exchange rate between the US dollar (USD) and the Zimbabwean dollar (ZWD) reflects ongoing economic challenges and market fluctuations in Zimbabwe. Recently, the exchange rate has seen significant volatility due to inflation, monetary policies, and external economic influences. Market conditions remain uncertain, with the Zimbabwean dollar experiencing rapid devaluation and fluctuations against major currencies. As of the latest data, 1 trillion Zimbabwean dollars is equivalent to a very small fraction of a US dollar, highlighting the extent of inflation and the currency’s depreciation. Investors and individuals should stay informed of the latest rates, as they impact transactions, savings, and economic strategies in Zimbabwe.

Currency Market Volatility and Influences

The current exchange rate from Zimbabwean dollars to US dollars reflects the ongoing economic fluctuations and market conditions impacting the currency market. With Zimbabwe’s monetary history marked by hyperinflation and currency reforms, the exchange rate remains highly volatile and subject to rapid changes influenced by political stability, fiscal policies, and external economic factors. The large sum of 1 trillion Zimbabwean dollars notably underscores the legacy of inflationary pressures that have drastically devalued the local currency against the US dollar.

Market conditions in the currency sector are shaped by a combination of domestic economic indicators, international trade dynamics, and global investor sentiments. Sharp fluctuations often occur due to interventions by the Reserve Bank of Zimbabwe, monetary policy adjustments, and economic reforms aimed at stabilizing the currency. Additionally, external influences such as commodity prices, foreign aid, and international sanctions play significant roles in shaping currency strength and stability in Zimbabwe.

Currency market volatility is heightened by unpredictable political developments, changes in government regulations, and shifts in global market confidence. These factors create an environment where exchange rates can experience sudden spikes or declines, directly impacting the value of holdings in foreign currencies. The overall influence is a complex interplay of internal economic health and external economic pressures, ultimately affecting the conversion rates between Zimbabwean dollars and US dollars.

Role of Central Bank Interventions

The current exchange rate between Zimbabwean dollars and US dollars is significantly influenced by market conditions, economic stability, and government policies. Fluctuations are often driven by inflation rates, foreign investment levels, and international trade dynamics, which collectively impact the value of the Zimbabwean dollar against the US dollar.

Market conditions such as currency demand and supply, investor confidence, and geopolitical risks play a crucial role in shaping the exchange rate. In Zimbabwe, hyperinflation has historically caused extreme currency volatility, making the USD a more stable reference currency for transactions and savings.

Central bank interventions are key tools used to stabilize the local currency. These interventions may include direct foreign currency purchases, adjustments to interest rates, or measures to control money supply. In Zimbabwe’s context, central bank efforts aim to curb hyperinflation and restore confidence in the currency, sometimes involving currency redenomination or issuance of new banknotes.

Given the scale of 1 trillion dollars worth of Zimbabwean currency, understanding market conditions and central bank strategies is essential. Such a large amount signifies considerable challenges in currency management, highlighting the importance of effective interventions to maintain economic stability and confidence in the currency exchange system.

Economic Implications of Converting Large Sums

The conversion of large sums of money, such as a trillion dollars from Zimbabwe to USD, carries significant economic implications. These transactions can influence currency stability, impact inflation rates, and affect the overall financial health of a nation. Understanding the broader effects of such substantial currency conversions is essential for assessing potential market shifts and economic stability.

Impacts on Zimbabwe’s Economy and Banking Sector

Converting large sums like 1 trillion dollars Zimbabwe to USD has significant economic implications for the country’s economy and banking sector. Such a massive currency conversion can lead to short-term disruptions in financial markets and banking operations, as institutions adjust to new valuation standards and revalue their holdings. It may also cause fluctuations in the exchange rate, potentially increasing volatility as market participants respond to the change. In the broader economy, this conversion can impact inflation rates, foreign investment, and overall economic stability, especially if perceived as a move toward currency normalization or a response to hyperinflation. Additionally, banks may face challenges in managing the transition, including reprocessing millions of transactions, updating system infrastructures, and maintaining liquidity during the period of adjustment. If managed effectively, the conversion could restore confidence in the monetary system; however, mishandled, it risks deepening economic instability and undermining investor trust.

International Trade and Foreign Investment Effects

The conversion of large sums, such as 1 trillion Zimbabwean dollars to USD, has significant economic implications, particularly in the context of international trade and foreign investment. When a central bank or government converts substantial amounts of its currency, it can influence exchange rates, impacting the competitiveness of exports and imports. An increase in foreign reserves through conversion may bolster investor confidence, encouraging foreign direct investment and boosting economic growth.

For Zimbabwe, converting a large sum of its currency into USD can stabilize inflation and restore trust in its monetary system, fostering a more conducive environment for international trade. As the country’s currency stabilizes, its exports may become more attractive to international markets, potentially increasing trade balances. Conversely, if such conversions lead to a significant increase in USD supply within the country, it might affect local monetary policies and inflation rates.

Moreover, large currency conversions often signal shifting economic conditions, attracting foreign investors seeking stable markets. It can also facilitate cross-border transactions by reducing currency risk and transaction costs. However, if not managed carefully, these conversions could lead to currency appreciation that hampers export competitiveness or cause balance of payments issues, highlighting the importance of strategic financial management in international trade and foreign investment contexts.

Local and Global Economic Perceptions

The conversion of large sums such as 1 trillion dollars in Zimbabwe into USD has significant economic implications both locally and globally. Such a substantial transfer or conversion can influence market perceptions, currency stability, and investor confidence. On a local level, converting a trillion dollars from Zimbabwean currency to USD could stabilize the economy by reducing inflationary pressures caused by hyperinflation and currency devaluation. It may also facilitate international trade and attract foreign investments, fostering economic growth. Globally, this level of currency conversion can signal confidence in Zimbabwe’s economic reforms or geopolitical stability, potentially strengthening the country’s reputation in financial markets. Conversely, abrupt or large-scale currency conversions may cause volatility, impacting exchange rates and influencing global currency markets. Overall, handling such transactions requires careful management to balance immediate economic stability with long-term financial health, considering both local economic needs and global market perceptions.

Case Studies and Historical Comparisons

Case studies and historical comparisons offer valuable insights into complex financial topics by examining past events and similar situations. In the context of Zimbabwe’s currency experiences, analyzing historical trends and case studies helps to understand the implications of a currency reaching notably high or low values, such as the country’s attempt to value the Zimbabwean dollar at 1 trillion in relation to USD. These approaches enable a deeper understanding of economic patterns, inflation, and monetary policy challenges faced by nations in similar circumstances.

Notable Hyperinflation Events in Zimbabwe

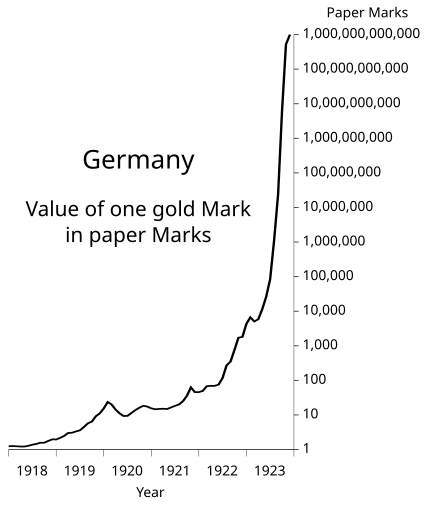

The hyperinflation event in Zimbabwe stands as one of the most notable cases in economic history, illustrating the dramatic impacts of excessive monetary expansion. During the late 2000s, Zimbabwe experienced an unprecedented surge in inflation rates, culminating in a peak where the Zimbabwean dollar reached denominations of 1 trillion and even higher, rendering cash practically worthless. This hyperinflation was largely driven by a combination of government expenditure, loss of confidence in the currency, and economic mismanagement.

Historically, hyperinflation events such as the German Weimar Republic in the 1920s and Yugoslavia in the 1990s offer useful comparisons. In Weimar Germany, rapid issuance of money to cover war reparations led to soaring prices and a collapsing currency value, similar to Zimbabwe’s scenario where the Zimbabwean dollar rapidly depreciated. Both cases demonstrate how excessive monetary supply without economic backing results in currency devaluation and chaos in everyday transactions.

In Zimbabwe, the hyperinflation peaked around 2008, with inflation rates estimated at hundreds of millions or even billions of percent annually. During this period, the government issued banknotes in increasingly higher denominations, some reaching 100 trillion Zimbabwean dollars. The erosion of trust led many to prefer foreign currencies such as the US dollar for transactions, effectively stabilizing the economy once hyperinflation was curtailed through dollarization. Consequently, the value of 1 trillion Zimbabwean dollars in 2008 became virtually worthless, highlighting the importance of monetary discipline and sound economic policies. Today, the USD remains a dominant currency in Zimbabwe, serving as a tangible reminder of the past hyperinflation’s devastating effects and the importance of prudent fiscal management.

Comparison with Other Countries’ Currency Crises

Historical comparisons of currency crises reveal that Zimbabwe’s hyperinflation and subsequent transition from a trillion-dollar note to the US dollar exemplify the severe economic instability that can result from excessive monetary expansion. Unlike many other countries that faced crises due to external shocks or political upheavals, Zimbabwe’s situation was largely driven by domestic monetary policy mismanagement, leading to inflation rates reaching unimaginable levels.

When comparing Zimbabwe’s case with other currency crises, such as the Latin American debt crises or the Asian financial crisis, the key difference lies in the causes and outcomes. Many crises involved speculative attacks, balance of payments issues, or reliance on foreign debt, whereas Zimbabwe’s crisis was characterized by hyperinflation and a complete breakdown of the local currency’s value.

Historically, countries like Argentina and Brazil have experienced inflationary spirals, but the scale and hyperinflation seen in Zimbabwe, where a 1 trillion Zimbabwean dollar note was issued, represent an extreme. The adoption of the US dollar in Zimbabwe was a strategic move to stabilize the economy, similar to how other nations like Ecuador and El Salvador employed dollarization to curb inflation and restore confidence.

Overall, Zimbabwe’s currency crisis underscores the importance of prudent monetary policy and fiscal discipline, with historical comparisons providing valuable lessons on the dangers of unchecked inflation and the potential benefits and limitations of currency stabilization measures.

Lessons Learned from Past Currency Reforms

Historical case studies of currency reforms provide valuable insights into the complexities and potential pitfalls associated with such economic interventions. They highlight the importance of careful planning, transparent implementation, and the necessity of maintaining public trust. In the context of Zimbabwe’s recent experience with a 1 trillion dollar banknote, examining past reforms reveals lessons on the dangers of hyperinflation and the importance of stable monetary policies.

One key lesson from past currency reforms such as Germany’s Weimar Republic in the 1920s or Zimbabwe’s own hyperinflation episodes is that printing excessive amounts of money to cover deficits can lead to rapid devaluation and loss of confidence. These cases demonstrate that currency stability depends on disciplined monetary management rather than simply increasing the money supply, regardless of denominations issued.

Furthermore, historical comparisons emphasize that sudden issuance of large denominations often results in the currency losing its function as a store of value and unit of account. Zimbabwe’s issuance of a 1 trillion dollar note was a response to hyperinflation, but it ultimately underscored the need for comprehensive economic reforms, including fiscal discipline and rebuilding of institutional credibility, rather than reliance solely on currency redenomination.

Ultimately, lessons learned from past currency reforms suggest that sustainable economic recovery requires a multifaceted approach, combining monetary stabilization, fiscal responsibility, and strengthening of economic institutions, rather than relying solely on monetary measures such as issuing high-denomination banknotes.

Future Outlook and Potential Currency Stabilization

The future outlook for Zimbabwe’s economy and its currency stability remains a topic of significant interest, especially in the context of the recent discussions surrounding the potential 1 trillion dollars in Zimbabwean currency being converted to USD. As the country navigates economic reforms and efforts to stabilize its financial systems, understanding the prospects for currency stabilization offers insight into possible economic recovery and integration with global markets. This exploration considers the factors that could influence Zimbabwe’s monetary future and the implications of currency conversion initiatives.

Strategies for Currency Stabilization

The future outlook for Zimbabwe’s currency stabilization, especially considering the context of a $1 trillion figure in USD, involves implementing comprehensive strategies to restore confidence and ensure economic stability. Achieving currency stabilization requires a multifaceted approach that addresses underlying economic imbalances and builds trust among stakeholders.

Strategies for currency stabilization include adopting prudent fiscal policies to control inflation and reduce fiscal deficits, which are vital for maintaining currency value. Additionally, establishing a credible monetary policy framework with the central bank playing a transparent role can help control money supply growth and stabilize exchange rates. Strengthening foreign currency reserves and promoting policies that attract foreign direct investment can bolster confidence in the currency. Implementing currency exchange reforms, such as floating exchange rates or managed regimes, can help respond more effectively to market forces. Lastly, fostering economic diversification and sustainable growth will underpin a resilient economy capable of supporting a stable national currency amidst fluctuating global markets.

Prospects for Re-establishment of a Strong Zimbabwean Currency

The future outlook for Zimbabwe’s currency stability and the potential for the re-establishment of a strong Zimbabwean dollar remain areas of significant interest and hope. With ongoing economic reforms and international support, there is a possibility for gradual stabilization of the currency, which has faced persistent challenges such as hyperinflation and loss of confidence.

Achieving a stable Zimbabwean dollar will likely depend on comprehensive fiscal policies, prudent monetary management, and measures to curb inflation. Restoring confidence among investors and the public is essential to foster a reliable financial environment and encourage economic growth.

Prospects for re-establishing a robust Zimbabwean currency are cautiously optimistic. Implementing currency reforms, strengthening financial sector infrastructure, and seeking international partnerships could contribute to a more stable monetary system. While hurdles remain, sustained efforts and strategic policies could pave the way for a stronger Zimbabwean dollar, improving the economic outlook and potentially attracting foreign investment.

Role of International Monetary Support and Policies

The future outlook for Zimbabwe’s $1 trillion debt conversion to USD hinges on several factors, including currency stabilization, international support, and effective policy implementation. Achieving stability in the local currency and establishing trust among international investors are critical steps toward fiscal recovery. International monetary support can play a pivotal role in facilitating this transition by providing financial aid, technical assistance, and policy guidance.

- Strengthening Currency Stability: Implementing sound monetary policies, combating inflation, and restoring confidence in the national currency are essential to prevent recurring devaluations.

- International Aid and Support: Securing financial assistance from international organizations such as the IMF and World Bank can help Zimbabwe manage its debt obligations and fund necessary economic reforms.

- Policy Reforms: Enacting comprehensive economic reforms, including fiscal discipline, transparency, and investment incentives, can foster a conducive environment for economic growth and currency stabilization.

- Debt Management Strategies: Developing clear strategies for debt restructuring and repayment plans will improve credibility with international lenders and investors.

- Promotion of Foreign Investment: Creating a stable political and economic landscape encourages foreign direct investment, which can further bolster currency reserves and economic stability.

Overall, coordinated efforts involving policy reforms, international support, and a focus on currency stabilization are vital for Zimbabwe to navigate its economic challenges and establish a sustainable financial future.

0 Comments