Understanding the Lagos Real Estate Market

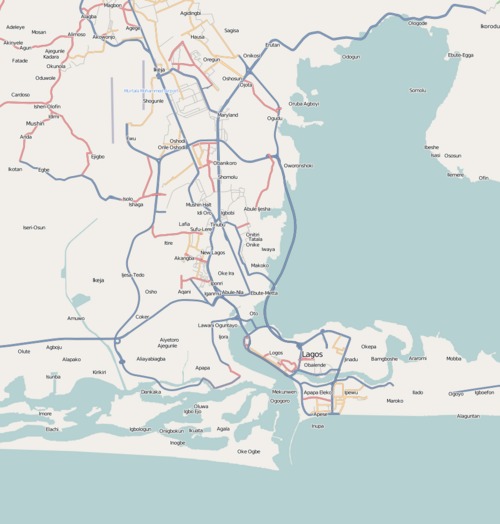

Understanding the Lagos real estate market is essential for anyone looking to buy a house in Lagos, Nigeria. This vibrant city offers a diverse array of property options, driven by its rapid urban growth and economic significance. Navigating the market requires knowledge of key trends, pricing dynamics, and the most sought-after neighborhoods to make informed investment decisions.

Current Market Trends in Lagos

Understanding the Lagos real estate market is essential for prospective buyers looking to purchase a house in Lagos, Nigeria. The market is highly dynamic, influenced by factors such as urbanization, population growth, and economic development, making it a lucrative investment destination. Currently, Lagos exhibits a blend of luxury apartments, affordable housing, and commercial properties, catering to a diverse range of investors and residents.

Recent market trends in Lagos show a rising demand for affordable housing in suburban areas, as many residents seek to escape the congestion of the city center. There is also an increase in the development of gated communities and estate complexes that offer security and modern amenities. Additionally, property prices continue to appreciate, driven by infrastructural improvements like new roads, public transportation projects, and commercial hubs expanding across the city. For investors looking to buy a house in Lagos, understanding these trends can help make informed decisions and capitalize on the city’s growth potential.

Key Factors Influencing Property Prices

Understanding the Lagos real estate market is crucial for anyone looking to buy a house in Lagos, Nigeria. The property market here is dynamic and influenced by various factors that shape property prices and investment opportunities.

One of the primary factors affecting property prices in Lagos is location. Prime areas such as Victoria Island, Lekki, and Ikoyi command higher prices due to their proximity to business hubs, amenities, and upscale lifestyles. Accessibility and connectivity also play a significant role, with well-connected neighborhoods generally experiencing higher demand.

Economic stability and income levels of residents influence the market significantly. Lagos, being Nigeria’s economic capital, attracts a large number of professionals and expatriates, which increases the demand for quality housing and drives up prices.

Infrastructure development, including road networks, transportation systems, and utilities, directly impacts property values. Areas with ongoing or planned infrastructure improvements tend to see increased interest and appreciation in property values.

Government policies, such as property regulations, tax incentives, and urban development plans, also shape the real estate landscape. Favorable policies can encourage investment, while restrictive regulations might limit market growth.

Supply and demand dynamics are fundamental in determining property prices. Limited available land in desirable locations often leads to increased prices, especially if the demand exceeds supply.

Finally, the overall global economic environment can influence the Lagos real estate market. Fluctuations in oil prices, foreign investment flows, and currency stability affect property values and investor confidence.

Understanding these key factors can help prospective buyers make informed decisions when aiming to buy a house in Lagos, Nigeria.

Forecast for the Lagos Housing Market

Understanding the Lagos real estate market is essential for anyone looking to buy a house in Lagos, Nigeria. The market is characterized by rapid growth, urbanization, and high demand for residential properties, making it a vital sector for both investors and homebuyers. Factors such as population influx, economic development, and infrastructural projects continually influence property values and market dynamics.

Looking ahead, the forecast for the Lagos housing market remains optimistic. Experts predict sustained growth driven by ongoing urban development and government initiatives aimed at increasing affordable housing options. However, potential buyers should also be mindful of market fluctuations, regulatory changes, and economic factors that could impact property prices. Overall, investing in Lagos real estate offers promising opportunities for those seeking to buy a house in Nigeria’s bustling commercial hub.

Types of Properties Available for Purchase

When considering the purchase of a house in Lagos, Nigeria, buyers have a diverse range of property types to explore. From luxurious apartments and modern condominiums to spacious single-family homes and commercial properties, the options cater to various preferences and budgets. Understanding the different types of properties available can help prospective buyers make informed decisions and find the perfect home that suits their needs and lifestyle in this vibrant city.

Residential Houses in Lagos

When looking to buy a house in Lagos, Nigeria, prospective buyers have a variety of property types to choose from. Residential houses in Lagos cater to different preferences and budgets, offering options such as detached houses, semi-detached houses, terraced houses, and luxury villas. Detached houses are standalone properties that provide privacy and ample space, ideal for families seeking solitude. Semi-detached houses are attached to another property, offering a balance of privacy and community living. Terraced houses are row houses that maximize space efficiency, often found in urban areas of Lagos. Luxury villas are high-end properties with premium amenities suitable for wealthy buyers looking for exclusivity and comfort. Each property type varies in size, location, price, and features, allowing buyers to select the most suitable option for their needs and investment goals.

Luxury Apartments and Condominiums

When considering buying a house in Lagos, Nigeria, prospective buyers have a variety of property options to choose from. These include luxury apartments and condominiums, which are increasingly popular among investors and residents alike.

Luxury apartments in Lagos offer high-end finishes, modern architectural designs, and a range of amenities such as swimming pools, gyms, and security features. They are often located in prime areas like Victoria Island, Ikoyi, and Lekki, providing convenient access to business districts, entertainment centers, and premium services.

Condominiums, on the other hand, typically refer to multi-unit residential buildings owned by individual owners but managed by a condominium association. They provide a balanced mix of comfort and affordability, often equipped with shared facilities like parking, 24-hour security, and recreational areas. These properties are ideal for those seeking a secure, community-oriented lifestyle in Lagos.

Both luxury apartments and condominiums serve different needs and preferences, but they are equally suited for individuals looking to invest in the thriving property market of Lagos, Nigeria. When purchasing these properties, it’s important to consider factors such as location, amenities, security, and potential for appreciation.

Commercial Property Options

When considering the purchase of a property in Lagos, Nigeria, there are several types of properties available to suit different needs and investment goals. Buyers have the opportunity to explore various commercial property options, each with unique features and benefits.

Commercial properties in Lagos include office buildings, retail spaces, warehouses, and industrial facilities. Office spaces are ideal for businesses seeking a central location with accessibility and ample infrastructure. Retail spaces, such as shopping malls and storefronts, serve as prime spots for retail businesses aiming to attract customers. Warehouses and industrial facilities cater to manufacturing, logistics, and storage needs, often located in business districts or industrial zones for convenience.

In addition to commercial options, Lagos offers residential properties like apartments, duplexes, and detached houses, which are popular among individuals and families. These properties come in various sizes and price ranges, accommodating different budgets and preferences. Whether for investment or personal use, understanding the diverse property types available helps buyers make informed decisions in the Lagos real estate market.

Vacant Lands and Plots

When considering buying a house in Lagos, Nigeria, prospects often explore various types of properties available, including vacant lands and plots. These options cater to different investment strategies and personal preferences, making it essential to understand their options and features.

- Residential Lands: These are plots designated for building homes, ranging from small family houses to large residential complexes.

- Commercial Lands: Plots intended for business purposes such as shops, offices, or industrial facilities, often located in strategic business districts.

- Agricultural Lands: Large plots suitable for farming or agribusiness ventures, common on the outskirts of Lagos.

- Mixed-Use Lands: Properties that combine residential and commercial elements, offering versatility and income-generating opportunities.

- Vacant Plots in Developments: Newly allocated or developed plots within estate projects, often with planned infrastructure and facilities.

- Redevelopment Properties: Existing properties that can be renovated or expanded, providing opportunities for customization and growth.

Choosing the right property type depends on your investment goals, budget, and intended use. Whether you aim to build a dream home or invest in land for future development, understanding the available options in Lagos is key to making an informed decision.

Legal Considerations When Buying a House in Lagos

Buying a house in Lagos, Nigeria, involves careful consideration of various legal aspects to ensure a smooth and secure transaction. Understanding the legal framework, including property rights, registration processes, and applicable regulations, is essential for prospective buyers. Being aware of potential legal pitfalls can help prevent future disputes and guarantee that your investment is protected.

Property Ownership Laws in Nigeria

When buying a house in Lagos, Nigeria, understanding the legal considerations and property ownership laws is essential to ensure a smooth and secure transaction. Nigerian property laws are primarily governed by the Land Use Act of 1978, which centralizes land ownership under the government and local authorities, granting individuals long-term leases rather than outright ownership of the land.

It is crucial to verify the title of the property before purchase, ensuring that the seller has a valid and clear title, such as a Certificate of Occupancy or a Governor’s Consent, which confirms their legal right to sell the property. Engaging a qualified lawyer to conduct a title search can prevent future disputes and legal complications.

Additionally, prospective buyers should be aware of the importance of thorough due diligence on land allocation and planning permissions. Only consider properties that have been properly documented and registered with the Land Registry Office to avoid issues related to illegal subdivisions or unapproved constructions.

Understanding Nigerian property laws also involves recognizing the importance of the transaction process, including the signing of a Sale Agreement, payment of stamp duties, and registration of the property transfer with the relevant land registry. Adherence to these legal procedures safeguards your investment and guarantees ownership rights.

To summarize, when buying a house in Lagos, it is vital to work with reputable real estate agents and legal professionals familiar with Nigerian property laws to navigate legal requirements effectively and secure your property rights in accordance with Nigerian law.

Necessary Documentation

When buying a house in Lagos, Nigeria, it is essential to understand the legal considerations to ensure a smooth transaction. Proper legal due diligence helps protect your investment and prevents future disputes. Familiarizing yourself with the necessary documentation is a crucial step in this process.

The key documents required include the Title Deed, which proves the seller’s ownership of the property, and the Certificate of Occupancy, indicating the government’s approval for the land or property use. It is also important to verify the Survey Plan to confirm the property’s boundaries and location. A No Objection Letter from the relevant land authority may be needed to facilitate the transfer of ownership.

Additionally, ensure that the sale agreement is properly drafted and signed by both parties, clearly outlining the terms and conditions of the sale. It is advisable to conduct a search at the Land Registry to confirm that there are no existing liens, encumbrances, or claims against the property. Engaging a qualified lawyer experienced in Lagos property law is vital to assist with these legal processes and ensure compliance with all regulatory requirements.

Having all necessary documentation verified and properly documented provides legal security and peace of mind when purchasing a house in Lagos, Nigeria. Taking these precautions helps safeguard your investment and ensures a hassle-free property acquisition.

Due Diligence Processes

When buying a house in Lagos, Nigeria, understanding the legal considerations and due diligence processes is crucial to ensure a smooth and secure transaction. Potential buyers must be aware of the legal framework governing property transactions to avoid future disputes or legal complications.

One of the first steps in due diligence is verifying the title of the property. This involves confirming that the seller holds a valid and clear title deed, free from encumbrances or outstanding charges. It is essential to conduct a thorough search at the Lagos State Land Registry to confirm the authenticity of the property’s ownership.

Buyers should also ensure that the property has the necessary legal approvals, such as building permits and land use certificates from relevant government agencies. These documents establish that the property was constructed and occupied legally and appropriately.

Engaging a qualified legal professional or property lawyer experienced in Lagos real estate is vital for reviewing all documents, drafting the sale agreement, and handling the transfer process. This helps safeguard against fraud and ensures compliance with local laws and regulations.

Another important aspect is understanding the tax obligations associated with property purchase, including stamp duties and registration fees, which must be duly paid to avoid future legal issues. Conducting comprehensive due diligence minimizes risks and ensures a legitimate and secure property investment in Lagos.

Engaging a Real Estate Lawyer

When buying a house in Lagos, Nigeria, engaging a real estate lawyer is crucial to ensure a smooth and legally sound transaction. A knowledgeable lawyer will help you navigate the complex property laws, verify the authenticity of the title, and prevent potential fraud or disputes. They can also review and draft necessary agreements, ensuring your interests are protected throughout the process.

Legal considerations include conducting a thorough title search to confirm ownership rights and checking for any encumbrances or liens on the property. Engaging a lawyer helps you understand the implications of land use policies, zoning regulations, and customary land rights that are prevalent in Lagos. Additionally, a lawyer can advise on the appropriate payment procedures and guide you through the registration process to secure proper title registration, safeguarding your investment for the future.

Steps to Buying a House in Lagos

Buying a house in Lagos, Nigeria, can be an exciting yet complex process that requires careful planning and knowledge of the local real estate market. Understanding the key steps involved can help you navigate the entire journey smoothly and make informed decisions. From financial preparations to legal considerations, each stage plays a vital role in securing your dream home in this vibrant city.

Budget Planning and Financing Options

Buying a house in Lagos, Nigeria requires careful planning and understanding of the financial options available. Proper budget planning ensures you can secure a property within your means, while exploring various financing options can make ownership attainable.

Steps to Buying a House in Lagos

- Conduct thorough research on the Lagos real estate market to identify suitable areas and properties.

- Determine your budget based on your savings, income, and potential financing options.

- Engage a reputable real estate agent to assist in finding properties that match your criteria.

- Visit prospective properties to assess their condition, location, and amenities.

- Carry out due diligence by verifying the property documents, ownership status, and legal compliance.

- Make an offer and negotiate the purchase price with the seller.

- Secure financing if needed, through banks, mortgage institutions, or other lenders.

- Pay the necessary fees, including stamp duties, legal fees, and registration charges.

- Complete the legal process by signing the sale agreement and registering the property with the Land Registry.

Budget Planning and Financing Options

Effective budget planning involves assessing your financial capacity, setting aside funds for initial deposit, and accounting for additional costs like legal fees and taxes. It is essential to have a clear picture of how much you can afford to spend and to plan accordingly.

- Savings: Use personal savings as a down payment to reduce loan dependency.

- Bank Loans: Many banks in Nigeria offer mortgage or home loan facilities with flexible repayment terms.

- Government Schemes: Explore any government-backed programs or schemes aimed at easing homeownership.

- Private Lenders: Alternative financing options from private lenders or cooperative societies may be available.

- Partnerships: Consider joint ownership or partnership arrangements to pool resources.

Careful planning of your budget and understanding your financing options will help you navigate the process of buying a house in Lagos smoothly and achieve your homeownership goals.

Finding a Reliable Real Estate Agent

Buying a house in Lagos, Nigeria, can be a rewarding experience if you follow the right steps and work with a reliable real estate agent. Ensuring that you choose the right property and agent will make the process smoother and more secure.

- Research the Market: Begin by understanding the Lagos real estate market, including popular neighborhoods, price ranges, and available properties.

- Determine Your Budget: Establish a clear budget considering additional costs such as legal fees, taxes, and agency commissions.

- Identify Your Needs: List your requirements such as location, size, type of property, and amenities desired.

- Find a Reliable Real Estate Agent: Look for experienced and reputable agents with good reviews and proper licensing. Recommendations from trusted sources or online platforms can help.

- Visit Properties: Schedule viewings with your agent to inspect potential properties thoroughly and ask questions about the property’s history and legal status.

- Conduct Due Diligence: Verify ownership documents, check for any encumbrances, and ensure the property has a clear title.

- Make an Offer: Once satisfied, negotiate the price and terms with the seller through your agent.

- Secure Financing: If needed, arrange for mortgage or other financial support from banks or financial institutions.

- Complete Legal Processes: Hire a lawyer to prepare and review sale agreements, conduct searches, and facilitate legal transfer of ownership.

- Finalize Transaction and Take Possession: Pay the agreed amount, execute the necessary legal documents, and take possession of your new property.

Property Viewing and Selection

When looking to buy a house in Lagos, Nigeria, the property viewing and selection process is a crucial step to ensure you make the right choice. First, identify your preferred locations within Lagos based on your budget, lifestyle, and future plans. Next, compile a list of available properties that meet your criteria through real estate agents, online platforms, or property listings.

Once you have your list, schedule visits to view these properties personally. During viewings, carefully inspect the condition of the house, checking for structural integrity, amenities, and overall suitability. Take note of important features such as security, accessibility, and proximity to essential services. It’s also advisable to assess the neighborhood and visit at different times of the day to gauge living conditions.

Compare the properties based on your observations, considering factors like price, location, and amenities. If possible, seek advice from real estate professionals to gather insights about the market value and potential investment benefits. After selecting a property that best fits your needs and budget, proceed to the next step of negotiations and legal due diligence to ensure a smooth buying process.

Negotiating the Sale

Buying a house in Lagos, Nigeria involves several important steps to ensure a smooth transaction. First, it’s essential to conduct thorough research to identify suitable properties within your budget and preferred location. Engaging a reputable real estate agent can facilitate the process and provide valuable insights.

- Determine Your Budget: Assess your financial capacity and get pre-approved for a mortgage if necessary.

- Identify Suitable Properties: Use online portals, estate agents, and local inquiries to find potential houses in Lagos.

- Visit Properties: Schedule visits to see the properties firsthand and evaluate their condition and suitability.

- Verify Property Documentation: Ensure the title deeds are clear and legitimate, and check for any encumbrances or legal issues.

- Make an Offer: Negotiate the price with the seller, considering market value and property condition.

- Negotiate Terms: Discuss other terms of the sale such as payment schedule, inclusions, and closing date.

- Draft a Sale Agreement: Have a legal professional prepare or review the agreement to protect your interests.

- Arrange Payment: Fulfill the payment commitments as agreed upon, ensuring all transactions are documented.

- Completion and Transfer: Complete the legal procedures for transfer of ownership, including registration at the land registry.

Negotiating the sale in Lagos requires clear communication, understanding of property value, and a willingness to compromise. Always approach negotiations professionally and be prepared to walk away if terms are unfavorable. Working with legal and real estate professionals can help you secure a fair deal and avoid potential pitfalls in the process of buying a house in Lagos, Nigeria.

Making an Offer and Agreement

Buying a house in Lagos, Nigeria involves several important steps to ensure a smooth transaction. First, prospective buyers should conduct thorough research to identify preferred neighborhoods and property types. It is advisable to engage with reputable real estate agents or brokers who can facilitate property viewings and provide valuable market insights. Once a suitable property is found, the next step is to carry out a detailed inspection and verify the ownership status through proper title searches at the Land Registry.

After confirming the property’s legitimacy, making an offer is the subsequent step. Buyers should negotiate terms with the seller, including the price, payment schedule, and other conditions. It is recommended to have a written proposal or offer letter outlining all agreed-upon terms. When both parties agree, they proceed to draft a sale agreement that details the transaction specifics, including payment terms, possession date, and any contingencies.

Signing the agreement signifies a commitment to the purchase. Both buyers and sellers should review the document carefully, preferably with legal counsel, to ensure all legal obligations are met. Once the agreement is signed and the necessary payments are made, the transfer of ownership is completed with the registration of the property at the Land Registry. This process secures the buyer’s legal rights to the property and ensures a protected investment in Lagos, Nigeria.

Getting a Property Inspection

Buying a house in Lagos, Nigeria, is an exciting but complex process that requires careful planning and research. One crucial step is getting a property inspection to ensure the property’s condition and worthiness. Here are the steps involved in the process:

- Research and Identify Property: Begin by searching for available properties within your budget and preferred location in Lagos through real estate agents, online portals, or property markets.

- Visit the Property: Conduct physical visits to inspect the property’s condition, location, and accessibility to amenities.

- Engage a Professional Inspector: Hire a qualified property inspector or surveyor to carry out a thorough inspection of the property.

- Property Inspection Process:

- Structural Analysis: Check the foundation, walls, roof, and overall structural integrity.

- Electrical and Plumbing Systems: Inspect wiring, fixtures, plumbing pipes, and water systems for safety and functionality.

- Ventilation and Hygiene: Assess ventilation, drainage, sanitation systems, and pest control measures.

- Legal Verification: Verify the property’s title, ownership documents, and ensure there are no legal disputes or encumbrances.

- Review Inspection Report: Carefully review the inspector’s report to identify any repairs or issues that need addressing before proceeding.

- Negotiate Purchase Terms: Based on inspection findings, negotiate the price and conditions of sale with the seller.

- Finalize the Sale: Complete legal documentation, make the payment, and register the property with relevant authorities.

Signing the Sale Agreement

When buying a house in Lagos, Nigeria, signing the sale agreement is a crucial step that formalizes the transaction between the buyer and the seller. Before signing, ensure that all terms and conditions are clearly outlined and understood, including the purchase price, payment schedule, and property details. It is advisable to review the agreement carefully, possibly with legal assistance, to confirm that your interests are protected. Verify that the property documentation is complete and authentic, including certificates of occupancy, title deeds, and survey plans. Once satisfied, both parties should sign the agreement in the presence of witnesses, and copies should be exchanged and kept for records. This step marks the legal commitment to transfer ownership and is essential for the subsequent process of registration and transfer of title in Lagos, Nigeria.

Transfer of Ownership and Registration

Buying a house in Lagos, Nigeria involves several important steps to ensure a smooth and legal transfer of ownership. First, conduct thorough research on the property and the developer or seller to verify their credibility. Next, engage a professional real estate agent and a legal practitioner to guide you through the process. It is essential to carry out a title search at the Lands Registry to confirm the property’s ownership and check for any encumbrances. Once satisfied, negotiate and agree on a purchase price, followed by signing a Memorandum of Understanding (MoU) or Sale Agreement.

After the agreement, pay the necessary deposits and arrange for the payment of subsequent installments if applicable. The next step involves obtaining a Survey Plan and paying the relevant fees for registration. The transfer of ownership is formalized at the Lands Registry, where the legal transfer document (Deed of Assignment) is processed. The new owner must pay the applicable stamp duties and registration fees as required by law.

Following the registration, the property is officially documented under the new owner’s name, completing the registration process. It is advisable to ensure the issuance of a Certificate of Occupancy or Title Deed, which serves as legal proof of ownership. Throughout this process, working with qualified professionals will help avoid legal pitfalls and ensure that the transfer of ownership and registration are correctly executed. Once completed, you can comfortably take possession of your new home in Lagos, Nigeria.

Cost and Budgeting for a Home Purchase

When planning to buy a house in Lagos, Nigeria, understanding the basics of cost and budgeting is essential for a successful and stress-free purchase. Knowing how to estimate expenses, set a realistic budget, and manage financial resources can help you find a property that fits your financial situation while avoiding unexpected costs. Proper budgeting ensures you can navigate the housing market confidently and make informed decisions throughout your home-buying journey.

Average Price Ranges in Lagos

When considering buying a house in Lagos, Nigeria, understanding the cost and budgeting process is essential for making an informed decision. Lagos is known for its diverse real estate market, offering a wide range of properties across various price points to suit different budgets and preferences.

The average price ranges for homes in Lagos vary significantly depending on the location, size, and quality of the property. For affordable housing, you can find studio apartments and small flats in areas like Egbeda and Ikorodu, with prices starting from approximately 10 million Naira. Mid-range homes in neighborhoods such as Surulere, Maryland, or Yaba typically cost between 30 million to 70 million Naira. Luxury properties in upscale districts like Victoria Island, Lekki, and Ikoyi can range from 150 million Naira to over 1 billion Naira for prime estates and waterfront villas.

When budgeting for a home purchase in Lagos, it is crucial to consider additional costs such as legal fees, registration charges, agent commissions, and potential renovation or repair expenses. It’s advisable to set aside at least 10-15% of the property price for these extra costs. Securing a mortgage or financing plan may also influence your overall budget, so exploring various financing options can be beneficial.

Overall, understanding the average price ranges and estimating your total budget will help you narrow down suitable options and make confident purchasing decisions in Lagos’s competitive real estate market.

Additional Costs (Legal Fees, Taxes, etc.)

When buying a house in Lagos, Nigeria, understanding the total cost involved is essential for effective budgeting. Beyond the agreed purchase price, there are several additional costs that buyers must consider to avoid surprises during the process.

Legal fees are a significant part of these additional costs. Engaging a qualified lawyer for property verification, registration, and transfer ensures the transaction’s legality. Typically, legal fees in Lagos can range from 1% to 2% of the property value, depending on the complexity of the transaction.

Taxes such as stamp duties and value-added tax (VAT) also contribute to the total cost. Stamp duty in Nigeria is usually about 0.5% of the property value, payable to government authorities. VAT may apply on certain property transactions, especially in commercial real estate, varying based on current regulations.

Additional costs may include registration fees for property documents, surveying fees, and potential agent commissions if a real estate agent is involved. It’s crucial to factor in these expenses to ensure that your overall budget accurately reflects all necessary outlays when purchasing a home in Lagos.

Financing and Mortgage Options

When buying a house in Lagos, Nigeria, understanding the cost and budgeting process is crucial to ensure a smooth transaction. It involves assessing your financial capacity, considering additional expenses, and choosing suitable financing options to make homeownership achievable.

Key factors to consider include property prices, registration fees, legal costs, and potential renovation expenses. Setting a clear budget helps prevent overspending and aligns your purchase with your long-term financial goals.

Several financing and mortgage options are available in Lagos for prospective homeowners:

- Bank Mortgages: Many banks in Nigeria offer mortgage loans with different interest rates and repayment terms, often requiring collateral and proof of income.

- Government Schemes: Programs like the Federal Mortgage Bank of Nigeria provide affordable home loans for eligible Nigerians, often with lower interest rates and longer payment periods.

- Partnership Programs: Some private developers and financial institutions collaborate to provide financing options tailored for first-time buyers.

- Alternative Financing: Personal savings, family contributions, or informal lending can also be part of your financing strategy, especially for smaller or initial payments.

Careful budgeting, exploring various mortgage options, and seeking professional advice can facilitate a successful home purchase in Lagos, Nigeria, while ensuring financial stability in the long run.

Benefits of Buying a House in Lagos

Buying a house in Lagos offers numerous benefits for both residents and investors. As Nigeria’s bustling economic hub, Lagos provides a vibrant lifestyle, diverse neighborhoods, and excellent infrastructure. Owning a property in this dynamic city can also be a valuable investment opportunity with potential for appreciation and rental income. Additionally, homeownership in Lagos grants stability, security, and the chance to become part of a thriving community.

Investment Potential

Buying a house in Lagos offers numerous benefits, especially regarding investment potential. Lagos is Nigeria’s largest commercial hub with a rapidly growing population, which drives consistent demand for real estate. This high demand can lead to substantial appreciation in property value over time, making it a lucrative investment.

Additionally, owning a house in Lagos provides long-term financial security and a sense of stability. Property ownership acts as a reliable asset, which can be leveraged or rented out for steady income. The city’s development projects and infrastructural improvements further enhance the value of real estate, ensuring that properties remain a sound investment choice.

Furthermore, purchasing a house in Lagos grants access to various economic opportunities, social amenities, and lifestyle conveniences that attract investors and residents alike. These factors collectively contribute to the upward trajectory of property prices, making Lagos an attractive location for both personal residence and lucrative real estate investment.

Ownership Security

Owning a house in Lagos offers significant ownership security, providing stability and peace of mind to property owners. When you purchase a home in Lagos, you establish legal rights over your property, safeguarding it from potential disputes or unlawful claims. This ownership security ensures that your investment is protected, allowing you to build equity and future wealth. Additionally, property ownership in Lagos can serve as a reliable asset that appreciates over time, offering long-term financial stability and security for you and your family.

Location Advantages and Amenities

Buying a house in Lagos offers numerous benefits, including potential for high rental yields due to the city’s booming real estate market. It provides a stable investment opportunity and a sense of security for homeowners. Additionally, owning property in Lagos allows residents to enjoy urban comforts and better quality of life.

Lagos’s strategic location provides easy access to major commercial centers, ports, and transportation networks, making commuting convenient. Its proximity to key business districts and international airports enhances connectivity for both business and leisure pursuits. The city’s diverse neighborhoods cater to various preferences, whether luxury, family-friendly, or affordable housing.

Residents benefit from a wide range of amenities including modern shopping malls, top-tier educational institutions, healthcare facilities, recreational parks, and entertainment venues. These amenities contribute to a comfortable lifestyle and support the growing needs of individuals and families living in Lagos, making it an ideal place for investment and residence.

0 Comments