Historical Background of Zimbabwe’s Currency Inflation

The Zimbabwean currency experienced one of the most dramatic cases of hyperinflation in history, culminating in the issuance of the infamous 100 trillion Zimbabwe dollars note. This surge in inflation was largely driven by economic instability, government mismanagement, and a decline in productive activities, which dramatically devalued the currency. As inflation spiraled out of control during the late 2000s, the country resorted to increasingly higher denominations of banknotes, eventually reaching unprecedented denominations like the 100 trillion note as a symbol of the economic crisis faced by Zimbabwe.

Origins of the Economic Crisis

The 100 trillion Zimbabwe dollars note symbolizes the severe economic turmoil that Zimbabwe experienced during its hyperinflation period in the late 2000s. The roots of this crisis can be traced back to a combination of political instability, land reform policies, and economic mismanagement that destabilized the country’s financial system. Following independence in 1980, Zimbabwe initially maintained a relatively stable economy; however, as land seizures and redistribution policies intensified, agricultural productivity declined, leading to reduced export income and food shortages. To address mounting fiscal deficits, the government began printing more money, which fueled rapid inflation. Over time, inflation spiraled out of control, reaching hyperinflation levels that rendered Zimbabwean currency virtually worthless, culminating in the issuance of the infamous 100 trillion dollar note as a symbol of the economy’s collapse. This period demonstrates how policy decisions and economic mismanagement can provoke inflationary spirals, eroding savings, destabilizing markets, and eroding public trust in currency.

Introduction of the 100 Trillion Dollar Note

The 100 trillion Zimbabwe dollars note is a symbol of the extreme economic instability faced by Zimbabwe during the late 2000s. This period was marked by hyperinflation, which severely devalued the country’s currency and disrupted daily economic activities. The origins of this crisis can be traced back to economic mismanagement, declining agricultural productivity, and a decline in foreign investment, all of which contributed to a sharp decline in output and revenue. To cope with mounting fiscal deficits and to finance increasing government expenditure, the Reserve Bank of Zimbabwe resorted to printing more money, leading to runaway inflation.

As inflation rates skyrocketed, Zimbabwe’s currency rapidly lost its value, reaching a point where banknotes of increasingly higher denominations had to be issued. The 100 trillion dollar note was introduced in 2008 as part of this catastrophic inflationary spiral, becoming a symbol of the country’s economic turmoil. The note was part of a series of increasingly high denominations designed to keep up with the hyperinflation, which eventually reached an estimated 79.6 billion percent month-on-month in November 2008. The issuance of such large notes illustrated the inability of the government to stabilize the currency and maintain economic control during this tumultuous period.

Factors Leading to Hyperinflation

The 100 trillion Zimbabwe dollars note is a symbol of the severe hyperinflation that plagued Zimbabwe during the late 2000s. The country’s currency experienced a dramatic loss of value due to a combination of economic mismanagement, political instability, and excessive money printing. Hyperinflation in Zimbabwe began in the early 2000s as the government faced declining agricultural and industrial productivity, leading to a shrinking economy. To finance increasing budget deficits and public debts, the Reserve Bank of Zimbabwe resorted to continuously printing more money. This excessive money supply, without corresponding growth in goods and services, led to runaway inflation rates, peaking at an estimated 79.6 billion percent month-on-month in November 2008. The issuance of high-denomination notes like the 100 trillion dollar bill became necessary to cope with the rapid devaluation of the currency. Factors leading to hyperinflation included land reform policies disrupting agricultural output, declining foreign investment, loss of confidence in the government’s economic management, and the collapse of productive sectors. The result was a dollar that lost almost all its value, forcing Zimbabwe to eventually abandon its own currency in favor of foreign currencies for stability.”

Design and Features of the 100 Trillion Dollar Note

The 100 trillion Zimbabwe dollar note is one of the most iconic and extraordinary banknotes in history, symbolizing a period of hyperinflation and economic turmoil in Zimbabwe. Its unique design and security features reflect the country’s effort to combat counterfeit threats while serving as a remarkable artifact of monetary instability. The note’s intricate artwork, vibrant colors, and advanced security measures make it a notable example of currency innovation during a turbulent economic era.

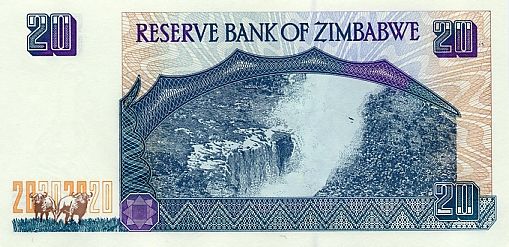

Visual Elements and Artwork

The 100 trillion Zimbabwe dollar note is a remarkable piece of currency history, featuring intricate design elements and distinctive artwork that reflect the nation’s economic challenges and resilience. Its visual elements include bold, prominent numerals displaying the denomination, complemented by vibrant colors and complex patterns that enhance security and aesthetic appeal. The note often showcases national symbols, such as the Zimbabwe bird or flora and fauna endemic to the region, emphasizing cultural pride. Artistic embellishments incorporate detailed engravings and microprinting, making counterfeiting difficult while highlighting craftsmanship. Overall, the design merges functionality with symbolism, creating a striking banknote that captures a significant moment in Zimbabwean monetary history.

Security Features and Anti-counterfeiting Measures

The 100 trillion Zimbabwe dollar note is a remarkable currency note characterized by its innovative design and advanced security features to prevent counterfeiting. Its vibrant coloration and intricate artwork depict significant national symbols and themes, reflecting Zimbabwe’s rich cultural heritage. The note measures a substantial size, accommodating detailed imagery and security elements that enhance its authenticity. The note incorporates multiple security features including watermarks, security threads, microprinting, and holographic elements, making replication difficult for counterfeiters. Additionally, special features such as color-shifting inks, ultraviolet-visible elements, and embedded fluorescent fibers further bolster its security. These anti-counterfeiting measures ensure the integrity and trustworthiness of the currency, maintaining its value amid periods of hyperinflation and economic instability. The combination of sophisticated design and robust security features exemplifies efforts to maintain the currency’s credibility in the financial system of Zimbabwe.

Physical Specifications and Dimensions

The 100 trillion Zimbabwe dollar note is a remarkable piece of currency history, showcasing advanced design features and unique physical specifications. It was issued during a period of hyperinflation in Zimbabwe and intended to serve as a high-denomination note for daily transactions.

The note features intricate artwork with vibrant colors and detailed security elements to prevent counterfeiting. Prominent images include national symbols and motifs representative of Zimbabwe’s cultural heritage, along with sophisticated watermarks and holographic features for added authenticity.

In terms of physical specifications, the 100 trillion Zimbabwe dollar note measures approximately 210 mm in width and 135 mm in height, making it a relatively large banknote. It is printed on high-quality, durable paper to withstand handling, with a textured surface that enhances its security features. The note incorporates various security threads, microprinting, and color-shifting inks to ensure its authenticity and to combat forgery. Overall, its design and dimensions reflect the extraordinary economic circumstances during its issuance, making it a notable collectible item today.

Economic Impact of the 100 Trillion Dollar Note

The introduction of the 100 trillion Zimbabwe dollar note marked a significant moment in the nation’s economic history, reflecting the severe hyperinflation that plagued the country during the late 2000s. This astronomical denomination was a symbol of the rapid decline in the Zimbabwe dollar’s value and highlighted the challenges faced by the economy. Examining the economic impact of this note provides insight into the effects of hyperinflation, currency devaluation, and the broader struggles of stabilizing the economy during a period of financial crisis.

Occasion and Public Reception

The release of the 100 trillion Zimbabwe dollars note was a significant event in the country’s economic history, symbolizing a period of extreme hyperinflation. Issued during a time when inflation rates soared to unprecedented levels, the note reflected the desperate economic situation Zimbabwe faced. The occasion of issuing such an enormous denomination was primarily to facilitate daily transactions amidst rapidly diminishing currency value, but it also became a controversial symbol of economic instability. Public reception to the note was mixed; many citizens viewed it as a tangible sign of the nation’s financial crisis, while others saw it as a desperate attempt by authorities to maintain some semblance of monetary order. Over time, the note became more of a collector’s item than a practical currency, illustrating the collapse of confidence in Zimbabwe’s economic system and the challenges faced in stabilizing the economy during that period.

Effects on Cash Transactions and Daily Life

The 100 trillion Zimbabwe dollar note is a symbol of hyperinflation and economic instability that profoundly affected daily life and cash transactions in Zimbabwe. As the highest denomination issued during a period of extreme inflation, this note became a practical necessity for even small transactions, illustrating the devaluation of the currency. Many citizens faced difficulties in performing routine financial activities, often needing to carry large amounts of cash just to purchase basic goods or services. The widespread use of such high-value notes underscored the loss of confidence in the banking system and the Zimbabwean economy at large, leading to a shift toward alternative payment methods such as bartering, foreign currency, and digital transactions. Overall, the note’s presence reflects the severe economic crisis that eroded the stability and predictability of everyday financial exchanges, complicating daily life for Zimbabweans during that turbulent period.

Role in Restoring Confidence in the Financial System

The introduction of the 100 trillion Zimbabwe dollar note marked a significant moment in the country’s economic history, symbolizing the extreme levels of hyperinflation that Zimbabwe experienced. Despite its seemingly astronomical denomination, the note ultimately became a symbol of the economic turmoil rather than a practical currency. In terms of economic impact, the issuance of such a high-value note was an attempt by the Reserve Bank of Zimbabwe to address the soaring inflation and cash shortages, aiming to restore confidence in the financial system by demonstrating an effort to support daily transactions.

However, the note’s role in restoring confidence was limited, as it primarily reflected the depth of economic instability rather than stability or recovery. Instead of stabilizing the economy, the issuance of the 100 trillion dollar note underscored the severity of hyperinflation and eroded public trust in the currency’s value. This led to a shift towards alternative currency solutions, such as foreign currencies and the eventual introduction of a new local currency. Ultimately, while the note was a physical representation of monetary policy challenges, its broader economic impact was more about highlighting the need for comprehensive reforms and confidence-building measures rather than serving as a catalyst for economic recovery.

Collectibility and Cultural Significance

The 100 trillion Zimbabwe dollars note stands as a remarkable symbol of both economic history and cultural resilience. Collectibility of such currency goes beyond its face value, reflecting its unique story and significance in Zimbabwe’s economic journey. This note encapsulates a period of hyperinflation and the nation’s efforts to adapt, making it a notable artifact for collectors and cultural enthusiasts alike.

Demand Among Collectors and Investors

The 100 trillion Zimbabwe dollars note holds a unique place in the world of collectibles due to its extraordinary face value and historical context. Its rarity and symbolic significance in Zimbabwe’s economic history make it highly sought after by collectors and investors alike. The note exemplifies a period of hyperinflation that captivated global attention, turning it into a tangible piece of economic history.

As a collectible item, the 100 trillion Zimbabwe dollars note is valued for its historical importance, rarity, and the story it represents. Investors see it not just as a banknote but as a symbol of economic resilience and hyperinflation, which has catapulted it into the realm of cultural significance. It also appeals to those interested in financial history, politics, and social movements, making it a highly meaningful artifact.

The demand among collectors and investors remains high, driven by several factors:

- The extraordinary face value and unusual denomination make it visually striking and memorable.

- Its association with a significant period of Zimbabwe’s economic crisis enhances its historical appeal.

- Limited availability, as most notes were destroyed or lost, increasing rarity.

- Interest from global numismatic communities and those interested in hyperinflation phenomena.

- Its potential as a conversation piece and a symbol of economic lessons for educational purposes.

Symbolism of Hyperinflation and Economic Collapse

The 100 trillion Zimbabwe dollars note stands as a powerful symbol of hyperinflation and economic collapse, capturing the extreme stresses faced by a nation’s economy. Collectibly, this note has become a highly sought-after artifact, representing a historical period marked by extraordinary financial instability. Its enormous denomination signifies the rapid devaluation of the currency, serving as a stark reminder of the devastating impacts of unchecked inflation. Culturally, the note embodies a collective experience of hardship and resilience, often evoking memories of a nation struggling to maintain stability amid economic chaos. As a piece of history, it reflects broader themes of economic mismanagement, political turmoil, and the lengths to which currencies can devalue under hyperinflation, making it a potent symbol for both economic lessons and the import of monetary discipline. Collectors and historians alike see the 100 trillion Zimbabwe dollar note as a tangible reminder of one of the most dramatic episodes of economic failure in recent history, encapsulating the complex interplay between economics, politics, and society.

Memorialization in Zimbabwean History and Culture

The 100 trillion Zimbabwe dollars note stands as a powerful symbol of the country’s complex economic history and its cultural memory. During a period of hyperinflation in the late 2000s, this note became more than just a monetary instrument; it turned into a relic that captures a significant chapter in Zimbabwe’s national story. Its collectibility underscores its rarity and the extraordinary economic circumstances that led to its issuance, making it a sought-after artifact for both numismatists and historians alike.

- Historical Significance: The note represents Zimbabwe’s experience with hyperinflation, which peaked in 2008, illustrating the economic challenges faced by the nation.

- Cultural Memory: It has become a visual reminder of a period marked by economic instability, resilience, and the country’s ongoing efforts toward recovery.

- Memorialization: The note preserves the memory of a unique economic phenomenon, serving as a memorial piece that reflects the struggles and adaptations of Zimbabwean society during that era.

- Collectible Value: Due to its rarity and the story behind it, the 100 trillion dollar note holds an important place in the collection of currency memorabilia, symbolizing both economic history and cultural endurance.

Legacy and Lessons Learned

The 100 trillion Zimbabwe dollar note stands as a symbol of a challenging economic era marked by hyperinflation and financial instability. Exploring the legacy of this extraordinary currency provides insight into the impacts of economic crisis and the lessons learned from such turbulent times. Understanding its significance helps in comprehending the broader implications for monetary policy and economic resilience in times of crisis.

Transition to a New Currency

The 100 trillion Zimbabwe dollar note stands as a symbol of a hyperinflation-era economy and offers valuable lessons about financial stability and monetary policy. Its issuance reflected the extreme economic instability faced by Zimbabwe during the late 2000s, where inflation reached unprecedented levels, rendering the currency almost worthless. This situation highlighted the importance of sound fiscal management and the dangers of unchecked money supply expansion.

Transitioning to a new currency, often backed by stronger monetary policies and international assistance, became crucial to restore confidence and stabilize the economy. The lessons learned include the need for prudent currency management, transparency in monetary decisions, and the importance of establishing credible institutions to prevent similar crises in the future. The legacy of the 100 trillion dollar note underscores the importance of sustainable economic practices and thoughtful transition strategies when moving to a new monetary system.

Economic Reforms Post-Hyperinflation

The 100 trillion Zimbabwe dollars note symbolizes one of the most extreme examples of hyperinflation and its long-lasting effects on a nation’s economy. This currency note reflects the aftermath of economic turmoil and the difficulties faced in stabilizing the economy after such a crisis. The legacy of hyperinflation in Zimbabwe has left both economic and social lessons that continue to influence reforms and policy decisions today.

One of the key lessons learned is the importance of maintaining prudent monetary policies and fiscal discipline to prevent hyperinflation. Zimbabwe’s experience underscored how rapid money supply expansions and loss of confidence can lead to currency collapse. As a result, economic reforms post-hyperinflation have focused on stabilizing the currency, restoring confidence, and encouraging growth.

Post-hyperinflation reforms typically include dollarization or the implementation of more stable foreign currencies, strict monetary policies, and structural adjustments. These measures aim to control inflation, rebuild the financial sector, and create a predictable environment for investment and everyday transactions.

- Restoration of monetary stability through credible central banking policies.

- Introduction of more transparent and disciplined fiscal management.

- Building institutional capacity to prevent future inflationary shocks.

- Promoting economic diversification to reduce dependency on unstable sectors.

- Encouraging investor confidence via policy consistency and transparency.

In summary, the 100 trillion Zimbabwe dollar note stands as a stark reminder of hyperinflation’s destructive impact and offers valuable lessons in economic management, emphasizing the significance of responsible fiscal policies and the resilience needed for sustainable economic recovery.

Implications for Modern Monetary Policy

The 100 trillion Zimbabwe dollar note serves as a powerful symbol of hyperinflation and the economic upheaval experienced during Zimbabwe’s economic crisis in the late 2000s. Its existence highlights the dangers of excessive money supply growth, loss of confidence in currency, and the importance of prudent monetary policy. The lessons learned from this period emphasize the need for central banks to maintain inflation targets, ensure fiscal discipline, and establish credible institutions to sustain economic stability.

- Unrestrained money printing led to the rapid devaluation of the Zimbabwean dollar, rendering the currency almost worthless and necessitating the issuance of increasingly higher denominations like the 100 trillion dollar note.

- The hyperinflation eroded savings, destabilized markets, and caused severe disruptions to everyday economic activity, illustrating the critical importance of controlling inflation to preserve economic stability.

- The crisis demonstrated that reliance solely on monetary expansion to finance government deficits can have disastrous consequences, underscoring the need for balanced fiscal and monetary policies.

- For modern policymakers, the Zimbabwe experience highlights the importance of transparent communication and maintaining credibility to prevent inflation expectations from becoming unanchored.

- The aftermath of hyperinflation underlines the significance of instituting independent central banks and credible monetary frameworks that can adapt to economic shocks without succumbing to inflationary pressures.

These lessons inform current monetary policy by emphasizing caution in monetary expansion, fostering fiscal sobriety, and strengthening institutions to ensure long-term financial stability.

0 Comments