Historical Context of Zimbabwe’s Currency Crisis

The Zimbabwean currency crisis reached a dramatic peak in the late 2000s, culminating in the issuance of the infamous 100 trillion dollar note. This period was marked by hyperinflation, economic instability, and a loss of confidence in the local currency. Initially driven by economic mismanagement, land reform policies, and political turmoil, the country’s monetary system rapidly deteriorated, forcing the government to print increasingly larger denominations in an attempt to keep up with spiraling prices. The 100 trillion dollar note became a symbol of this economic chaos, reflecting the unprecedented scale of inflation faced by Zimbabwe during that era.

Origins of Hyperinflation in Zimbabwe

The 100 trillion dollars Zimbabwe note symbolizes the severe economic turmoil faced by the country during its currency crisis, which was rooted in a complex history of political instability, economic mismanagement, and hyperinflation. Zimbabwe’s currency crisis emerged in the late 1990s and early 2000s as a result of declining agricultural productivity, declining foreign investment, and government overspending, leading to a loss of confidence in the local currency.

The origins of hyperinflation in Zimbabwe can be traced back to a series of policy decisions, including land reforms that disrupted agricultural output, and excessive money printing by the Reserve Bank of Zimbabwe. These actions increased the money supply drastically without corresponding economic growth, fueling rising prices and devaluing the currency. As inflation spiraled out of control, the government continuously increased denominations, culminating in the issuance of a 100 trillion dollar note as a symbolic reflection of the hyperinflationary environment.

This hyperinflation severely eroded the value of savings and wages, destabilized the economy, and led to shortages of basic goods. The crisis was further exacerbated by international sanctions and declining international trade, which limited economic recovery. The Zimbabwean dollar eventually became practically worthless, prompting the government to adopt foreign currencies such as the US dollar and South African rand for transactions, marking a significant shift away from the national currency and an end to the era of hyperinflation.

Impact of Economic Policies and Political Instability

The Zimbabwean currency crisis, exemplified by the iconic 100 trillion dollar note, is rooted in a complex historical context involving economic mismanagement and political instability. During the late 20th and early 21st centuries, Zimbabwe faced hyperinflation driven by excessive money printing, dwindling agricultural productivity, and a decline in investor confidence. Economic policies such as land reform programs and rigid price controls disrupted agricultural output and fueled economic decline, while the government’s inability to control inflation led to a loss of trust in the national currency. Political instability, marked by contested elections and authoritarian governance, further undermined economic stability, resulting in severe currency devaluation. The result was a cycle of soaring inflation rates, rendering the Zimbabwean dollar virtually worthless, and culminating in the issuance of high-denomination notes like the 100 trillion dollar bill, which became a symbol of the country’s economic crisis.

Sequence of Currency Reforms and Denominations

The Zimbabwe currency crisis reached a peak with the issuance of the 100 trillion dollar note, symbolizing the severe hyperinflation that plagued the country during the late 2000s. This period was marked by economic instability driven by political turmoil, land reforms, and a loss of confidence in the national currency. The crisis reflects a broader history of economic challenges faced by Zimbabwe, leading to a series of currency reforms aimed at stabilizing the economy and restoring trust.

Following the collapse of the Zimbabwean dollar due to hyperinflation, the country undertook several currency reforms, including redenominations and the introduction of foreign currencies. The sequence of reforms can be summarized as follows:

- Pre-hyperinflation period: The Zimbabwean dollar was introduced in 1980 after independence, functioning as the official currency with relatively normal inflation rates.

- Hyperinflation onset: In the early 2000s, inflation began to accelerate, reaching unprecedented levels by 2006, driven by government spending and economic mismanagement.

- Introduction of higher denominations: To cope with hyperinflation, the Reserve Bank issued increasingly larger banknotes, culminating in the 100 trillion dollar note in 2008.

- Currency shortages and replacements: By 2009, Zimbabwe abandoned the Zimbabwean dollar altogether, replacing it with foreign currencies such as the US dollar and South African rand.

- Reintroduction of a new currency: In 2019, Zimbabwe introduced a new Zimbabwean dollar (zwd), attempting to re-establish a national currency which faced initial challenges due to lingering inflationary pressures.

The issuance of the 100 trillion dollar note remains a symbol of the hyperinflation era in Zimbabwe, representing one of the highest denominations ever issued globally and highlighting the severity of the country’s economic crisis.

The 100 Trillion Dollar Note

The 100 trillion dollar note of Zimbabwe is one of the most famous examples of hyperinflation in recent history. Issued during a period of economic collapse, this denomination symbolizes the extreme measures taken by the country’s government to cope with rapidly devaluing currency. Despite its astronomical face value, the note became a powerful reminder of the economic challenges faced by Zimbabwe and the impact of hyperinflation on everyday life.

Design and Features of the Banknote

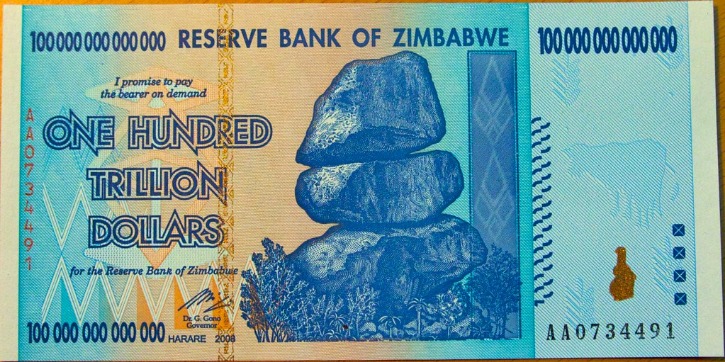

The 100 Trillion Dollar Note of Zimbabwe is one of the most famous hyperinflation-era banknotes in history, symbolizing the severe economic crisis that the country experienced in the late 2000s. Its design and features reflect both the inflationary environment and the efforts to portray national identity on a note of extraordinary denomination.

- Front Design: The note features intricate artwork depicting Zimbabwean wildlife and cultural symbols, such as elephants and traditional patterns, emphasizing national pride.

- Color Scheme: Bright and vibrant colors, including shades of green, orange, and yellow, are used to make the banknote visually striking.

- Portraits: Prominent figures or national icons are often included to emphasize Zimbabwe’s history and sovereignty, although the primary focus is on symbolic imagery.

- Security Features: Embedded security threads, watermarks with national symbols, and microprinting are incorporated to prevent counterfeiting despite the note’s high denomination.

- Denomination and Value: The front prominently displays “100 Trillion Dollars,” emphasizing the hyperinflationary collapse of the Zimbabwean dollar.

- Serial Numbers: Unique serial numbers are printed twice to enhance authenticity and traceability.

- Back Design: The reverse side continues with cultural motifs, landscapes, or symbolic imagery relevant to Zimbabwe’s heritage.

- Size and Material: The note was printed on durable paper, large in size compared to standard notes, to accommodate elaborate design elements.

This banknote stands as a historical artifact illustrating the severity of Zimbabwe’s hyperinflation crisis and highlights the design strategies used to manage such extraordinary currency denominations.

Circulation and Usage in Daily Transactions

The 100 trillion dollar note of Zimbabwe was introduced in 2008 amidst hyperinflation, making it one of the world’s most infamous currencies. Due to the extreme devaluation of the Zimbabwe dollar, this note was issued as a response to the rapidly increasing prices and the need for higher denomination bills for everyday transactions. While the note gained widespread attention, its actual circulation and usage in daily transactions were limited. Most Zimbabweans and businesses depended on foreign currencies like the US dollar and South African rand to conduct their daily activities, since the local currency had become unreliable. The 100 trillion dollar note largely became a symbol of hyperinflation rather than a practical medium of exchange. Eventually, the Zimbabwean government abandoned the domestic currency in favor of foreign currencies, rendering the note obsolete in everyday transactions. Today, the 100 trillion dollar note is considered a collector’s item and a historical artifact rather than a functional currency in the regular economy.

Public Perception and Media Coverage

The 100 trillion dollar note in Zimbabwe garnered significant public attention and media coverage due to its extraordinary face value during the hyperinflation period in the late 2000s. Many people saw it as a symbol of the economic turmoil that the country was experiencing, with the note often viewed as a reflection of the failed monetary policies and economic instability. Media outlets worldwide highlighted the note as one of the highest denominations ever issued and used sensational headlines to emphasize the severity of Zimbabwe’s hyperinflation crisis.

Public perception of the 100 trillion dollar note was mixed; some individuals viewed it as a tangible representation of the country’s turbulence, while others saw it as a symbol of loss of confidence in Zimbabwe’s economy. The note became a tourist attraction and a collector’s item, often bought as a souvenir or curiosity. In media coverage, stories often focused on the inflationary pressures, government responses, and the eventual move away from such high denominations, including dollarization and economic reforms.

Overall, the 100 trillion dollar note remains a powerful visual reminder of Zimbabwe’s economic struggles and the impacts of hyperinflation on everyday life. It continues to be referenced in discussions about monetary policy, economic stability, and the importance of prudent financial management, both in Zimbabwe and globally.

Economic Consequences of the 100 Trillion Dollar Note

The issuance of the 100 trillion dollar note by Zimbabwe in 2008 is a striking example of hyperinflation’s economic impact. This extraordinary measure was a response to severe economic instability, leading to skyrocketing prices and a loss of confidence in the currency. Exploring the economic consequences of this unprecedented banknote reveals insights into the destructive effects of hyperinflation on a nation’s financial system and daily life.

Inflation and Currency Devaluation

The introduction of the 100 trillion dollar note in Zimbabwe was a direct consequence of hyperinflation and severe economic instability. This extraordinary denomination was issued to cope with rapidly escalating prices, effectively rendering previous currency notes virtually worthless. Inflation soared, reaching unprecedented levels, which led to a loss of confidence in the national currency and a collapse in its real value. As a result, people resorted to barter or foreign currencies for everyday transactions, further undermining the local economy.

The issuance of such a massive note exacerbated inflationary pressures, fueling a vicious cycle where prices continued to rise faster than the ability of the economy to stabilize. Currency devaluation became widespread, causing the Zimbabwean dollar to lose its purchasing power domestically and internationally. This devaluation discouraged savings and investment, hampering economic growth and eroding the standard of living for most citizens. Ultimately, the extreme inflation and currency collapse forced the government to abandon the Zimbabwean dollar altogether and adopt foreign currencies to restore stability.

Effect on Savings, Investments, and the Economy

The introduction of the 100 trillion dollar note in Zimbabwe vividly illustrates the severe economic instability and hyperinflation faced by the country during that period. Such a massive denomination of currency reflects the rapid loss of purchasing power and the collapse of confidence in the monetary system. This inflationary environment had profound impacts on savings, investments, and the overall economy. People’s savings quickly became worthless, discouraging the accumulation of wealth and leading to a shift towards more stable assets or foreign currencies. Investments plummeted as entrepreneurs and businesses faced unpredictable costs and uncertain markets, stifling economic growth. The high inflation eroded real incomes, reduced consumer spending, and caused a contraction in economic activity. Additionally, the government struggled to finance operations, which further exacerbated economic decline. The 100 trillion dollar note thus became a symbol of the economic crisis, highlighting the detrimental effects of hyperinflation on a nation’s financial stability and developmental prospects.

Impact on Zimbabwe’s International Trade and Relations

The introduction of the 100 trillion dollar note in Zimbabwe had profound economic implications, particularly affecting the country’s international trade and diplomatic relations. This unprecedented monetary measure was a response to hyperinflation, but it also signaled underlying economic instability that influenced Zimbabwe’s positioning in global markets.

Regarding international trade, the hyperinflation and issuance of such a large denomination led to a decline in the currency’s value, discouraging foreign investment and making imports more expensive. This affected Zimbabwe’s ability to engage competitively in international markets. The devaluation also created difficulties for exporting businesses, as inflation eroded profit margins and disrupted supply chains.

In terms of international relations, the currency crisis contributed to a perception of economic fragility, leading to cautious or diminished trust from trading partners. Zimbabwe faced increased scrutiny and sanctions from some nations, which aimed to pressure reforms but also complicated diplomatic engagement. The hyperinflation crisis underscored the need for economic stabilization measures, influencing negotiations and foreign aid strategies.

Overall, the 100 trillion dollar note became a symbol of Zimbabwe’s economic struggles, impacting its international trade dynamics and diplomatic relationships in both negative and complex ways. Addressing these challenges required comprehensive reforms to restore confidence and stability in Zimbabwe’s economy.

Comparison with Other Historical Hyperinflations

The 100 trillion dollar hyperinflation in Zimbabwe stands as one of the most extreme examples of economic collapse in modern history. Comparing this incident with other notable hyperinflations, such as those in Weimar Germany, Hungary, and Yugoslavia, reveals common triggers like excessive money printing and political instability, as well as the devastating impact on everyday life. Understanding these parallels helps illustrate the dynamics of hyperinflation and its profound consequences for a nation’s economy and its citizens.

Weimar Germany and the 1923 Hyperinflation

The hyperinflation experienced in Zimbabwe, culminating in the infamous 100 trillion dollar note, can be compared to other historical episodes such as Weimar Germany’s hyperinflation and the 1923 German hyperinflation crisis. While the scale and contexts differ, all these instances share common features of rapid currency devaluation, loss of public confidence, and economic instability. In Weimar Germany, hyperinflation peaked in 1923, with prices doubling every few days, leading to money becoming practically worthless and requiring wheelbarrows of money for basic purchases. Similarly, Zimbabwe’s hyperinflation reached astronomical levels in the late 2000s, with the 100 trillion Zimbabwean dollar note symbolizing the extent of the monetary disaster. Despite differences in causes—Weimar’s inflation stemmed from war reparations and economic upheaval, whereas Zimbabwe’s hyperinflation was driven by excessive money printing to finance budget deficits and economic mismanagement—the outcomes reflect a loss of trust in the currency and severe disruptions to daily life. These episodes serve as stark reminders of the destructive potential of uncontrolled inflation and the importance of sound monetary policies.

Hungary’s Post-WWII Hyperinflation

Hungary’s post-World War II hyperinflation stands as one of the most severe cases in history, rivaling other notable instances such as Zimbabwe’s hyperinflation in the late 2000s. While Zimbabwe’s inflation reached extraordinary levels with the widely reported 100 trillion dollar banknote, Hungary’s hyperinflation during 1945-1946 experienced even greater devaluation, with the pengő experiencing inflation rates that rendered currency virtually worthless within months. The Hungarian government issued a series of increasingly high denominations, culminating in a 100 quintillion pengő note, which reflected the rapid loss of confidence and economic upheaval following the war. The key difference lies in the timing and scale; Hungary’s hyperinflation was fueled by the devastation of war, reparations, and economic collapse, leading to a peak that defied normal monetary measures. In comparison, Zimbabwe’s hyperinflation was driven by excessive money printing, political instability, and economic mismanagement, resulting in similar but slightly less severe inflation rates. Despite differences in context and duration, both cases exemplify the catastrophic effects hyperinflation can have on a country’s economy and currency stability.

Zimbabwe in the Context of Global Financial Crises

The 100 trillion dollar Zimbabwean banknotes symbolize one of the most extreme cases of hyperinflation in modern history, which took place during the late 2000s. Compared to other historical hyperinflations, Zimbabwe’s crisis was characterized by a rapid loss of monetary value driven by political instability, economic mismanagement, and corruption. Unlike the Weimar Republic in Germany (1921-1923), where hyperinflation followed a war reparations burden and led to a temporary but severe devaluation, Zimbabwe’s hyperinflation was compounded by a collapse in agricultural productivity, excessive money printing, and a decline in confidence in the currency. Similarly, Hungary’s post-World War II hyperinflation (1945-1946) was marked by an extremely high inflation rate, but it was resolved swiftly through monetary reforms. Zimbabwe’s case persisted over several years, leading to the issuance of staggering denominations like the 100 trillion dollar note. In the broader context of global financial crises, Zimbabwe’s hyperinflation stands out as an example of how political and economic missteps can exacerbate inflationary pressures, creating a situation where traditional monetary policies are ineffective. This contrasts with other crises, where external factors or war often played a significant role, illustrating the unique internal dynamics that can lead to hyperinflation. Ultimately, Zimbabwe’s experience underscores the importance of sound economic governance and the risks of unchecked monetary expansion during financial crises worldwide.

Lessons Learned and Economic Reforms

Lessons Learned and Economic Reforms are critical components in understanding the dramatic economic shifts experienced by countries like Zimbabwe. The nation’s journey toward stabilizing its economy and addressing hyperinflation offers valuable insights into the importance of strategic reforms and policy decisions. Examining Zimbabwe’s case highlights how economic lessons can inform future reforms to prevent similar crises and promote sustainable growth in challenging financial environments.

Transition to Multi-Currency System

The transition to a multi-currency system in Zimbabwe was a critical step in stabilizing the country’s economy after the hyperinflation crisis that reached 100 trillion dollars. Lessons learned from this experience highlight the importance of monetary discipline, credible policy measures, and the necessity of establishing market confidence to curb runaway inflation. The adoption of foreign currencies, such as the US dollar and South African rand, helped restore trust in the financial system and facilitated economic transactions. However, this transition also underscored the limitations of multi-currency arrangements, including issues of monetary policy independence and currency shortages. Moving forward, reforms focused on strengthening financial institutions, promoting fiscal responsibility, and gradually reintroducing a local currency are essential for sustainable economic growth. Zimbabwe’s experience demonstrates that comprehensive economic reforms, combined with prudent monetary and fiscal policies, are vital for overcoming hyperinflation and fostering economic stability in post-crisis environments.

Stabilization Measures and Policy Reforms

The experience of Zimbabwe’s attempt to stabilize its economy and implement reform measures highlights several critical lessons learned. These insights are vital for understanding the complexities of economic recovery and the importance of coordinated policy actions.

Lessons Learned

- Importance of Sound Fiscal Management: Unsustainable fiscal policies, including excessive borrowing and money printing, led to hyperinflation and economic collapse.

- Need for Transparent and Credible Institutions: Lack of trust in government and monetary institutions undermined reform efforts and discouraged foreign investment.

- Reforms Must Be Comprehensive: Partial or superficial reforms are insufficient; successful stabilization requires a combination of monetary, fiscal, and structural reforms.

- Timing and External Support Matter: Implementing reforms at the right time, often with international assistance, enhances their effectiveness and sustainability.

- Addressing Social Impact is Crucial: Reforms should consider their effects on vulnerable populations to prevent social unrest and promote social cohesion.

Economic Reforms, Stabilization Measures, and Policy Reforms

- Monetary Policy Adjustments: Introducing credible inflation-targeting frameworks and stabilizing the currency to regain public confidence.

- Fiscal Discipline: Reducing budget deficits through increased revenue collection and expenditure controls to restore fiscal sustainability.

- Structural Reforms: Restructuring state-owned enterprises, improving governance, and encouraging private sector growth to diversify the economy.

- Financial Sector Reforms: Strengthening banking systems, establishing transparent regulatory frameworks, and promoting financial inclusion.

- Currency Reforms: Considering currency stabilization or dollarization to curb hyperinflation and restore trust in the monetary system.

- International Cooperation and Support: Engaging with international bodies like the IMF and World Bank for technical assistance and financial aid to bolster reform efforts.

Implementing these lessons and measures is essential for Zimbabwe to recover from its economic challenges, rebuild trust, and lay the foundation for sustainable growth amidst the backdrop of a complex financial landscape involving trillions of dollars in economic activity.

Current Economic Outlook and Recovery Efforts

The economic landscape of Zimbabwe, particularly in relation to its astonishing 100 trillion dollar currency, offers valuable lessons about hyperinflation, monetary policy, and fiscal discipline. The inflation crisis underscored the importance of prudent monetary management and the dangers of excessive money printing, which eroded purchasing power and destabilized the economy. Policymakers learned that balancing inflation control with economic growth strategies is vital to maintain stability. Recent reforms have focused on stabilizing the currency, improving fiscal responsibility, and fostering environments conducive to investment.

The current economic outlook remains cautiously optimistic, with efforts aimed at restoring confidence, stabilizing inflation, and encouraging sustainable growth. Zimbabwe has initiated economic reforms that include currency redenomination, strengthening of banking systems, and implementing policies to attract foreign investment. These measures aim to restore trust in the financial system and lay the groundwork for economic resilience.

Recovery efforts are ongoing, emphasizing diversification of the economy beyond traditional sectors like agriculture and mining. The government is working to improve infrastructure, streamline business regulations, and promote technological innovation. International support and cooperation are also playing a role in facilitating economic stabilization and growth, with the goal of transforming Zimbabwe into a more stable and prosperous economy over time.

0 Comments